The Trend

Chinese consumers are becoming a growth engine for the global luxury market. The online shift of their luxury spending presents significant opportunities for brands willing to embrace a digital transformation.

Why the China Market Matters

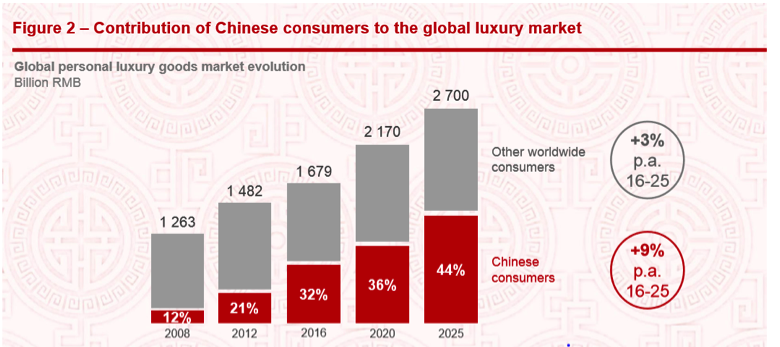

Chinese consumers are the biggest spending force in the global luxury market, accounting for 32% of global sales in 2017 versus 22% for U.S. consumers, who are in the second spot, according to consultancy Bain. The share of Chinese spending is vastly outgrowing that of shoppers from other countries: Global spending by Chinese nationals grew at 11%, while spending by the rest of the world (ex-Chinese spending) grew at 3% in 2016, according to a Bain report. Moreover, China’s share of global luxury spending is expected to reach 44% of the total global market by 2025, said a McKinsey report.

And Chinese consumers are returning to the domestic market for their shopping sprees, fueling a whopping 20% growth rate in the domestic Chinese luxury market in 2017, outpacing their spending growth in overseas markets, according to a report by Bain. Price-sensitive Chinese consumers started to favor the domestic market because international luxury brands, such as Louis Vuitton, Gucci, Hermès and Burberry reduced products prices in China after the Chinese government reduced import duties on consumer goods.

Source: McKinsey & Company “2017 China Luxury Goods Report: the One Trillion Yuan Opportunity”

Who’s the Chinese Luxury Consumer?

The wealthiest Chinese households are the most-influential group behind the robust luxury market performance in China and overseas. Wealthy Chinese consumers, those with household income over RMB 300,000, made 88% of Chinese luxury purchases in 2016, according to a survey by McKinsey. By 2025, these 7.6 million households will account for 91% of total Chinese luxury spending, with the top earners (household income above RMB 500,000) driving 61%, the same study predicted.

The forecast spending represents a RMB 1 trillion global sales opportunity in this sector, doubling the 2016 amount. Data from the Tmall platform shows a similar pattern: The number of highest spenders in luxury (those who spend RMB 200,000 or more) is growing fastest out of all groups, recording an 89% year-over-year increase and outpacing the 36% increase of the overall luxury shopper number.

Spenders are increasingly sophisticated, seeking unique ways to express themselves through luxury consumption. International brands are taking note: Fragrance brand Jo Malone offers personally-engraved perfume bottles for its Tmall customers; Italian luxury jacket brand Moncler announced its exclusive debut of the “Moncler Genius” collections in China on Tmall’s Luxury Pavilion. Tmall data showed a host of niche Chinese luxury brands, such as EXCEPTION, Ms Min and Comme Moi have emerged over the past few years, as consumers increasingly look for differentiated designs.

Another defining characteristic for Chinese luxury consumers is their young age: The average luxury consumer age in China is 35, or about 10 years younger than their counterparts in more-developed countries. Chinese millennials (those ages 20-34) are becoming frequent visitors to luxury shops in China and abroad. A survey conducted by Bain showed they are buying an average of eight luxury items every year, or three items more than the older age groups. And they are expected to spend more: 93% of millennials will buy more luxury goods in the next three years, the same survey said. The millennialization trend is more pronounced in the online channel. Sales to young shoppers under 30 accounted for 61.7% of the total luxury sales on Tmall in the last 12 months.

The Digital Future for Luxury is Now

In a country with such a young consumer base which shops for almost everything online, the 9% e-commerce penetration for the luxury sector suggests tremendous growth potential. Data from Alibaba’s platforms already show strong online demand for luxury products. Total luxury sales on Alibaba’s Tmall platform posted 46% growth in the past 12 months ending in June 2018, and the total number of luxury shoppers grew 36% in the same period.

An e-commerce channel also helps luxury brands capture potential customers in places where they don’t currently operate offline stores. For example, on the first day of its launch on Alibaba’s Tmall Luxury Pavilion, Versace reached customers from 283 cities across China through the platform. A significant number of these consumers came from third- and fourth-tier cities where the brand did not yet have a physical store. According to search engine Qihoo 360, tier-two and tier-three cities generated the highest share of luxury search queries in Q2 2018. Selling online also provides important insights into store expansion strategies in these lower-tier cities in the future.

The importance of a digital presence for luxury brands extends beyond pure transactions: A McKinsey report showed that nearly 80% of global luxury sales are “digitally influenced,” meaning consumers at some point of their purchase journey, seek inspiration from live-streaming sessions offered by their favorite influencers and brand websites, or they consult their peers for advice on social media. It is crucial to engage with Chinese consumers on e-commerce platforms where they already spend significant time getting fashion inspiration and socialize with their peers.

Tiffany is at the forefront of providing a differentiated online shopping experience. The recently launched a Tiffany pop-up store on Tmall’s Luxury Pavilion leverages augmented-reality to enhance the online shopping experience. Many items offered during a pre-sale period sold out.

The Takeaway:

Luxury brands have reached a tipping point to expand their digital footprints to stay top-of-mind with young and digitally native Chinese luxury consumers. Brands’ capabilities to utilize online channels to replicate the exclusive offline shopping experience online and engage with customers creatively will be key differentiators from their competitors.