China’s consumer economy continues to be the fastest-growing in the world, but companies seeking to effectively tap this growth need to understand changing buyer behaviors as the market becomes increasingly segmented.

That’s the conclusion of anew report by The Boston Consulting Group (BCG) and AliResearch, the research arm of Alibaba Group. The report, titled Five Profiles that Explain China’s Consumer Economy, says that asthe country’seconomy matures, its consumers are becoming more and more diverse. Rather than targeting large, homogenous demographic groups, companies need more detailed knowledge of these emerging buyer sub-classes and their distinct preferences and needs, according to BCG and AliResearch.

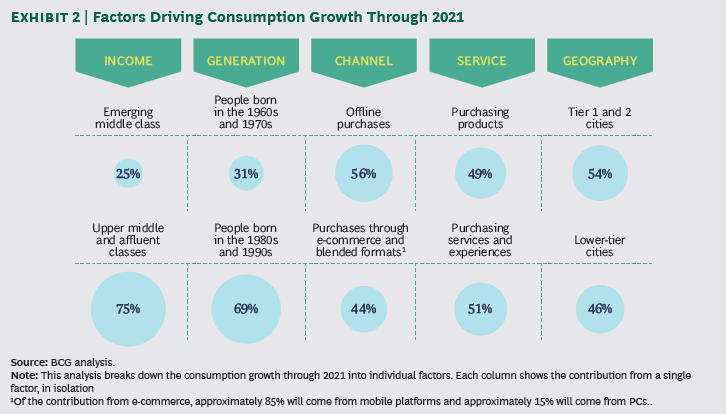

The report is a follow-up to a 2015 BCG collaboration with AliResearch titled The New China Playbook: Young, Affluent, E-savvy Consumers Will Fuel Growth. That document highlights some of the trends driving greater spending, including the growth of China’s emerging upper-middle-class and affluent households, spending bythe younger generation, and the expansion of e-commerce.

But “identifying these trends is not enough,” the new report says. In the past, retailers could achieve success with “a relatively basic consumer segmentation scheme built primarily around demographic factors such as age, gender and income.” Today,”companies need to drill down and look at more-granular information to understand how these trends affect the shopping habits and behaviors of Chinese consumers,” according to BCG authors, who added that “rising incomes and digital access are leading to a far more heterogeneous consumer market.”

Consumption is not limited to certain segments of the population. Instead, everyone in China is a potential consumer.

Despite thisincreasing complexity, China’s growth proposition remains hard to ignore because there are potentially trillions of dollars in sales up for grabs.

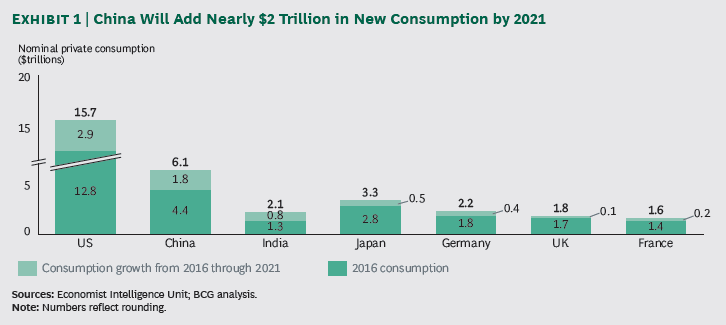

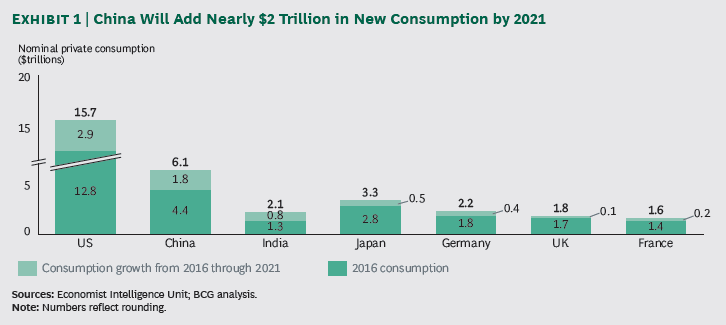

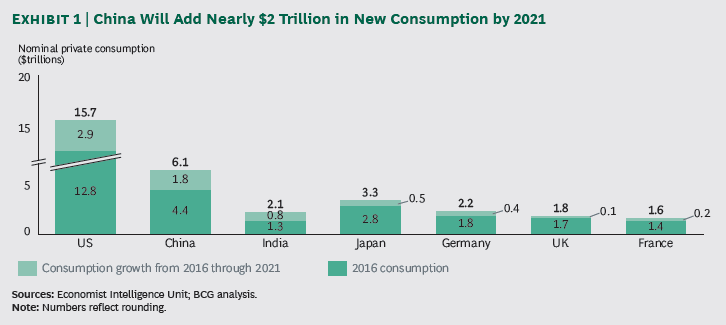

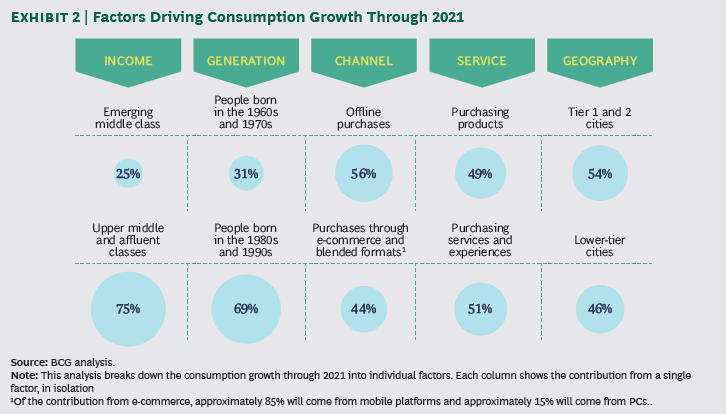

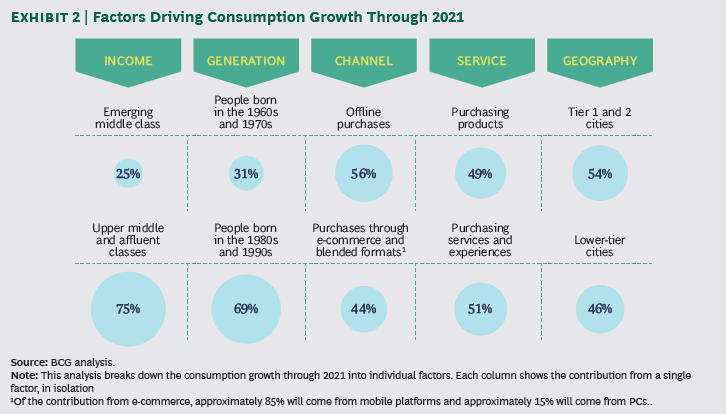

While the country’s overall GDP growth is slowing, consumer spending is still increasing by 10% a year, faster than that of any other country. By 2021, China, currently the world’s second-largest consumer market, will add $1.8 trillion in new consumption, expanding nearly 40% from last year’s levels to $6.1 trillion.By itself, consumption growth over the next several years willroughly equal the size of Germany’s consumer economy today, and will account for more than one-fourth of all consumption growth in major economies, according to BCG.

Increasingincomes and mobile internet technologies will continue to propel rising spending. “Chinese consumers in the aggregate are spending more, and they’re trading up to higher-quality products,” says Jeff Walters, a partner at BCG and coauthor of the report. “Digital technology is one of the underlying drivers that will continue to spur purchases. The Chinese population is more connected than people in other countries, and by 2021, 90% of all purchases in China will involve digital at some point in the process—browsing, comparing prices, or making the actual purchase.”

As more Chinese in more regions become active shoppers online and off, “everyone in China is a potential consumer,” says BCG. The report highlights this growing diversitybydetailingfive emerging consumer profiles illustrating distinct new consumer classes. The authors noted that while the list is not comprehensive, it demonstrates “how large structural changes are playing out at a macroeconomic level.” Here’s a synopsis of these consumer groups:

- The Savvy Shopper. Consumers are far more brand-aware than in the past, and consumption boundaries (like age and gender) are disappearing. For example, Chinese men in tier-one cities now spend 24 minutes a day on grooming, and 88% access grooming and fashion information online—both measures are up significantly in the past decade.

- The Single Person. Because of demographic shifts, people in China are increasingly likely to remain unmarried. Among urban dwellers, 21% of people older than 35 are single, up from just 4% a decade ago. This trend means growing demand for different types of products, such as furniture designed for one-person apartments, smaller appliances, and food sold in smaller sizes and convenient packaging.

- The Eco-conscious Consumer. Chinese shoppers are increasingly aware of environmental issues and sustainability; they want their products to be good for them and good for the planet. AliResearch found that 66 million customers (16.2% of the consumers on Alibaba’s China retail marketplaces) bought five or more green products in 2015, up from just 4 million in 2011 (3.4%). Just as important, these customers are willing to pay higher prices—33% more, on average—for sustainable products.

- The Passionate Trend Seeker. Chinese consumers are increasingly interested in not only products but also experiences that will enrich their lives. Rising income levels and greater exposure to the world are the driving forces for this trend, which includes travel to more exotic locales such as Africa, the Middle East, and the North and South poles. Extreme sports like rock climbing and surfing are also projected to grow rapidly in the next several years.

- The Connected Consumer. Quest Mobile researchers estimate that China has a staggering 927 million active mobile internet users. Buyers are keen on smart devices and services and are open-minded about the early adoption of new products and technologies such as smart refrigerators. Digitalization is changing consumer lifestyles. For example, digital entertainment means people are more likely to socialize with friends at home than go out. These changes trigger corresponding changes in the products these consumers buy.

Greater diversity means consumer companiesneed more precise ways to track and understand the factors that lead topurchase, and to make emotional connections with customers, according to BCG. A promisingstrategy to achieving thisis omnichannel retailing–what Alibaba Group calls New Retail–that merges online and offline marketing and sales.

By 2021, more than 90% of purchases will involve at least one digital touch point(up from 70% in 2016), be it a product recommendation texted by a friend or a livestreamed product review on a social media channel, according to BCG and AliResearch. This means consumer companies need to leverage digital technologies to the fullest, to reach more consumers and to better understand their needs by utilizing the data streams their online activities generate.

“As e-commerce becomes more prevalent, consumer companies must create a format that seamlessly integrates online and offline elements,” the report says.”At every step of the purchasing pathway, you need to design meaningful touch points that deepen your engagement with consumers, give you critical data and insights about their wants and needs, and help you with them over as brand loyalists who will advocate for you among their friends and family,” the report says.

Gao Hongbing, dean of AliResearch and vice president of Alibaba Group, went a step further, saying that not only is omnichannel a way to keep up with shifting consumption patterns–it will in itself become”an important driving force for the growth of consumption going forward.”

“A lot is changing in China, but the fundamental story is one of very strong growth through 2021,” says BCG’s Walters. “This market is growing by trillions of dollars, and companies that take the right steps today will set themselves up to win over the long term.”