Despite gloomy news about China’s economy, the majority of Chinese consumers are confident about their financial futures and are willing to keep spending. But as consumers grow more sophisticated and selective, retailers will need to adapt quickly to shifting trends and tastes to be successful in an increasingly nuanced marketplace.

These are findings from a new report from global consultancy McKinsey titled The Modernization of the Chinese Consumer that looks at consumer attitudes, brand loyalty and spending trends in China. “Consumer confidence has remained surprisingly resilient over the past few years as salaries have continued to rise and unemployment has stayed low,” McKinsey analysts wrote.

The report, which includes findings from 10,000 in-person surveys of consumers aged 18 to 64 across 44 cities, concluded that consumers are optimistic about future earnings, with 55 percent of survey participants saying they expected to earn significantly higher incomes over the next five years—a drop of just 2 percent from 2012.

This is good news for global and domestic retailers, but the report stressed that merchants must take into account new realities. As incomes have risen and consumption knowledge has increased, China’s shoppers are becoming more discriminating. The days of “fast, broad-based growth,” as researchers call it, are fading fast.

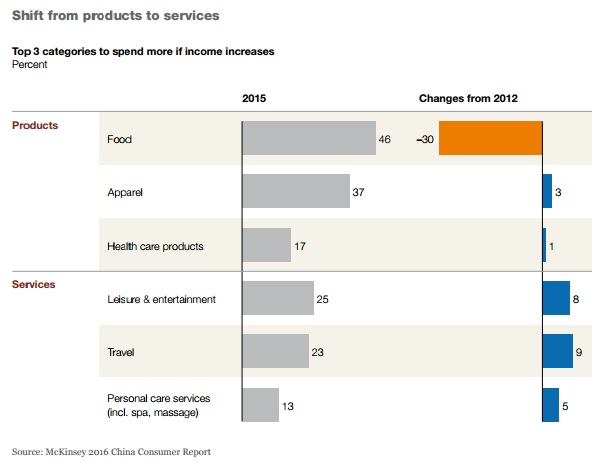

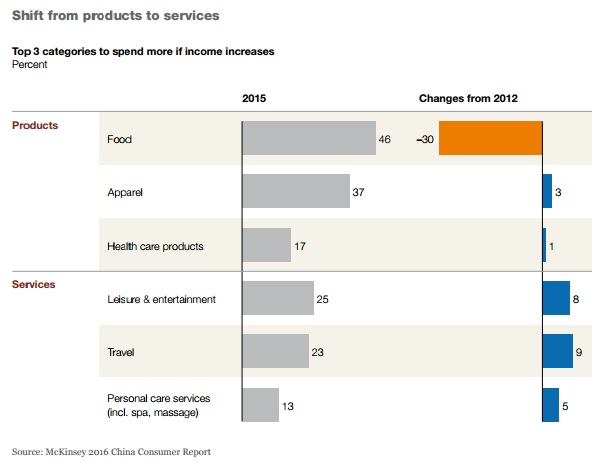

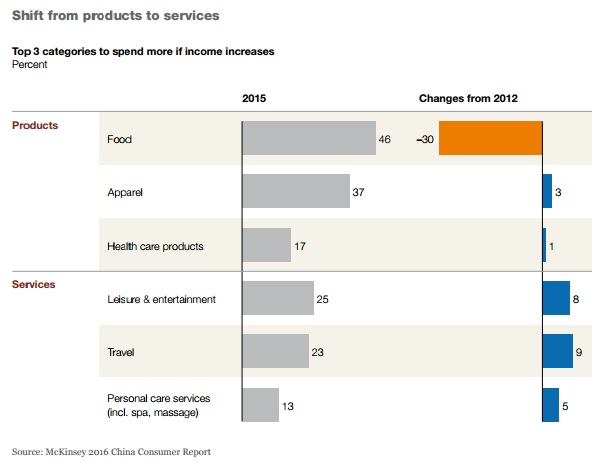

One indicator of that change is consumers’ continued shift away from a focus solely on products to greater demand for services and experiences. For instance, the survey showed that 25 percent of consumers are planning to spend more on leisure and entertainment compared with just 8 percent four years ago.

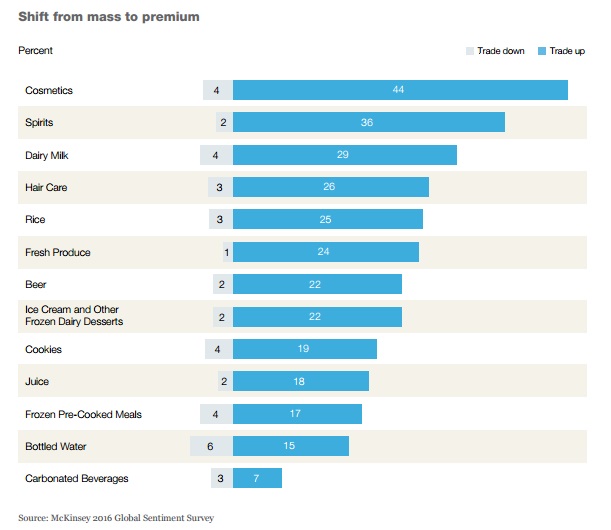

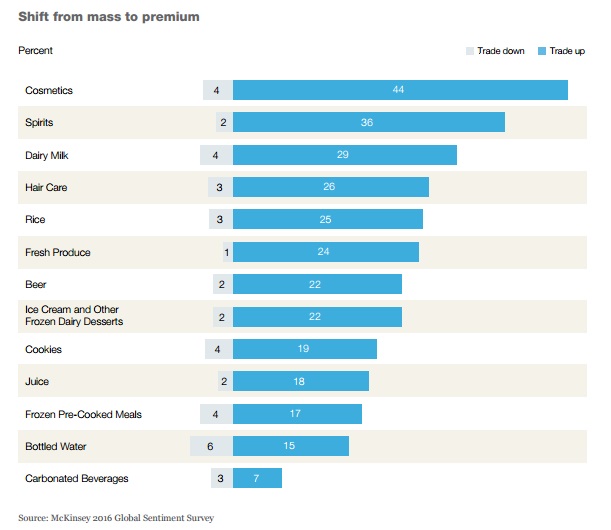

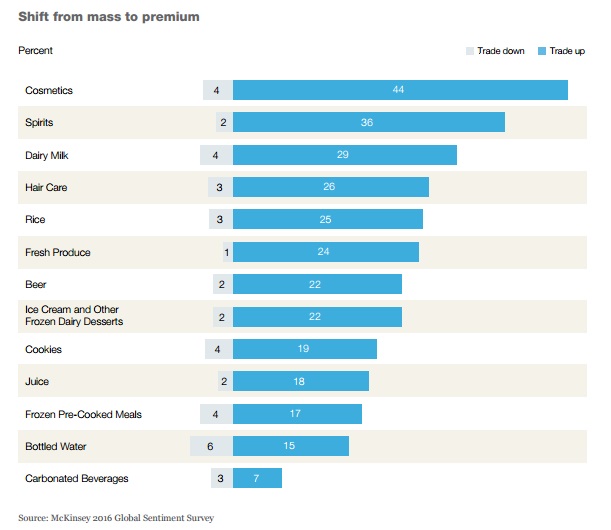

In another example of change that also highlighted the willingness to spend, data showed that consumers are continuing to move from mass to premium products. Cosmetics, spirits and dairy milk were the top three favorites. Analysts also noted, “Foreign brands still hold a leadership position in the premium segment.”

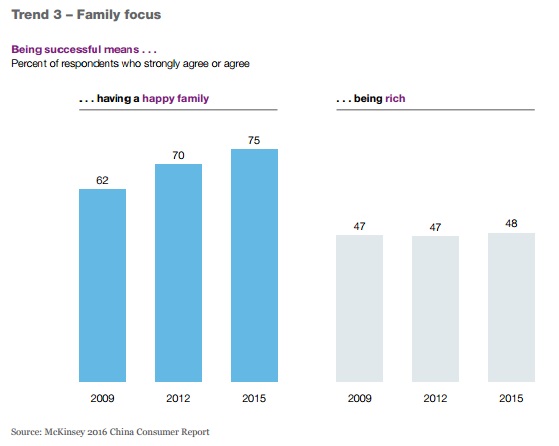

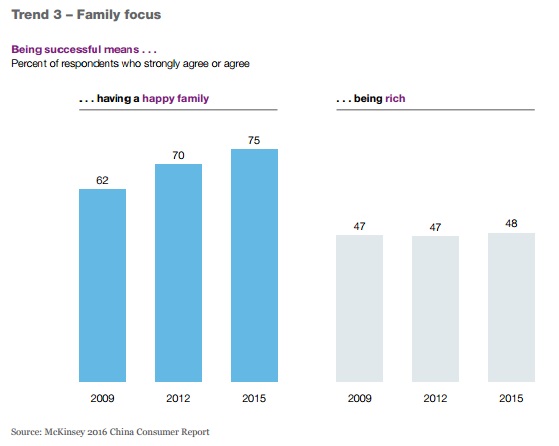

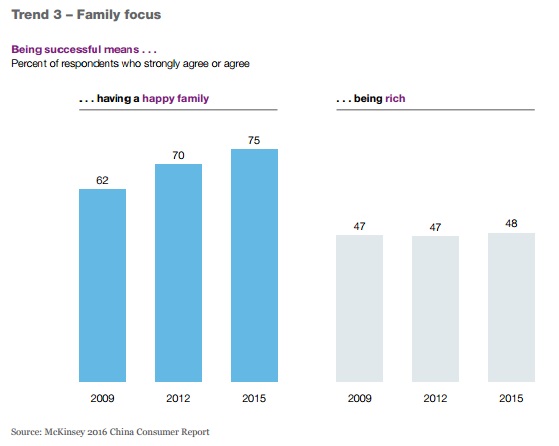

In two questions related to family life, McKinsey found that family happiness and time spent together is still valued by Chinese consumers.

One trend revealed that 75 percent of consumers define success as having a happy family, an uptick of 5 percent from 2012 and 13 percent from 2009. Meanwhile, “being rich” was relatively flat as a definition of being successful, with just 48 percent affirming compared to 47 percent four years earlier.

The concept of shopping as entertainment made inroads as well. The report found that 64 percent of respondents said a family shopping trip was one of the best ways to spend time together, an increase of 21 percent over 2012.

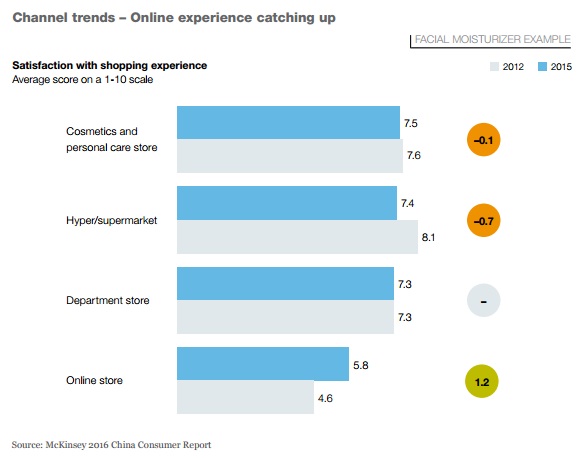

McKinsey also looked at preferences when it comes to shopping at brick-and-mortar stores compared with online channels. Though results showed consumers still prefer the in-person shopping experience, the gap between the two choices is narrowing—a phenomenon evident in the booming popularity of China’s e-commerce market, which is already the largest in the world with $672 billion in sales in 2015.

“Understanding and responding to the evolution of China’s consumers will be decisive in sorting out what companies win and lose, both international and domestic competitors,” McKinsey researchers wrote. “While scale, speed and simplicity proved advantageous during the past 15 to 20 years, the changing shape of Chinese consumption is set to topple some giants of the past, and elevate new champions.”