Cross-border e-commerce in China will hit $85.76 billion this year, up from $57.13 billion in 2015, as 40 percent of China’s online consumers buy foreign goods, according to a new analysis by digital marketing researcher eMarketer.

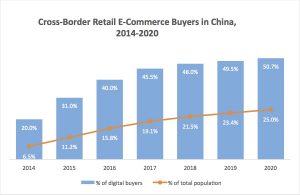

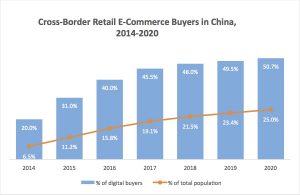

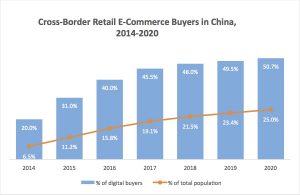

EMarketer estimates that each of China’s digital shoppers this year will spend an average of $473.26 on foreign goods, up from $446.33 last year. By 2020, half of China’s digital shoppers–or more than a quarter of the country’s population of about 1.4 billion–will be buying foreign products online, eMarketer estimates, with total sales of $157.7 billion.

This growth is part of an overall increase in online shopping in China, which soared more than 70 percent in 2015 to $672.01 billion driven in part by a higher standard of living and the advent of global digital sales platforms such as Alibaba’s Tmall Global, launched in 2014.

Tmall Global and other business-to-consumer, or B2C, platforms allow international brands to sell their products directly to China’s digital shoppers and break into the market. Online retail remains the easiest channel for all types of consumers to obtain products that are otherwise difficult or expensive to access within China. China’s consumers tend to prefer foreign goods in specific categories such as milk powder, diapers and pet food, perceiving them to be of higher quality and more trustworthy.

Cross-border e-commerce remains on the rise despite April’s implementation of a new tax on overseas purchases, noted eMarketer analyst Shelleen Shum. While itincreases prices slightly for some product categories such as jewelry and infant formula, “the demand for foreign goods via the cross-border e-commerce channel is still expected to remain strong due to better prices compared to offline retailers, perceived quality and better variety,” she said.

Shum addedthat B2C channels are alsointegral to the growth of foreign goods sales in China, because theyhelp customers feel they are getting more bang for their buck. B2C platform sales are expected to take up a growing share of the cross-border e-commerce market in 2016 as consumers shift to channels they regard as more professional and organized. “Since the merchants selling on these B2C platforms have to be authorized, they are considered more trustworthy,” noted Shum.

Globally, cross-border e-commerce habits vary. But when it comes to China, the demand for foreign products is surging, thanks to the combination of overseas travel, increased internet usage, exposure to foreign brands and convenience of online retail. China is projected to become the largest cross-border B2C market by 2020.