The Chinese consumer has become the holy grail of retail for companies across the globe as they target the growing purchasing power of China’s emerging middle class.

But according to new research from Goldman Sachs, the population of this key demographic still has a long way to go before it reaches critical mass. Indeed, while China has more working people than any other country—770.4 million—only 11 percent of the total population has reached the middle class. And less than 2 percent of workers even earn enough to pay income tax.

“So what the world has seen so far is only a preview of the opportunities to come,” Goldman wrote in the latest update of its “The Rise of China’s New Consumer Class” report.

(Source: Goldman Sachs Global Investment Research)

Those opportunities will come in the entertainment, food service and technology sectors, Goldman Sachs predicts, and most of the spend will come from rising disposable income among two distinct groups: the “Urban Middle,” currently made up of 146 million people earning $11,733 a year, and the “Urban Mass,” totaling 236 million people with annual incomes of $5,858. Goldman expects members of the latter group to boost spending as millions of blue collar and migrant workers shift to better paying jobs, while the Urban Middle, largely public-sector employees, see their spending power buoyed by salary increases.

Another important group is what Goldman termed “Rural Workers,” which, at 387 million people, account for half of China’s workers. They earn just $2,000 a year. The fourth and final tier among China’s consumers is the “Movers & Shakers” group, or about 1.4 million wealthy elite with at least $500,000 in annual income.

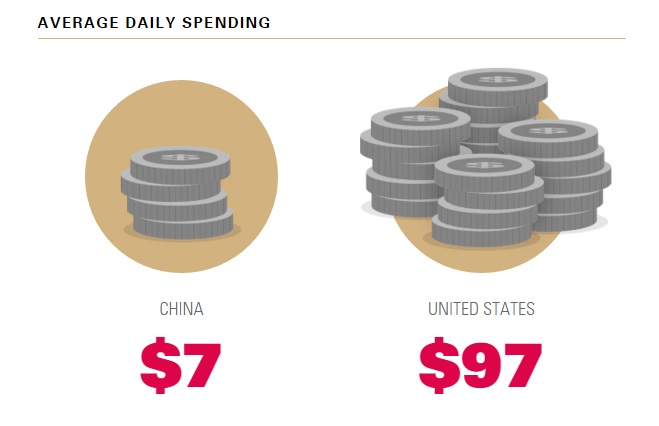

Goldman’s report reveals thatthe overwhelming majority of Chinese are at the low end of the pay scale, which is why the average daily spend in China is $7 compared with $97 in the U.S.The mainland’s consumers spend almost half their earnings on food and clothing, versus just 15 percent for Americans.

But Goldman expects this to change as incomes rise. “Fun” categories such as travel, dining out, sports and gaming, will draw the most spend, according to the investment bank. Again, spending in this category is far lower in China than other countries. In 2013, the Chinese spent just 9.2 percent of their earnings on leisure activities, compared with 17.3 percent for Americans.

“That gap means that as incomes rise, this category could see the biggest growth,” Goldman said.

Source: Euromonitor, CEIC, Goldman Sachs Global Investment Research

The method by which this spending will take place is important. Goldman notes that brick-and-mortar commerce in China are still relatively underdeveloped, and the low rate of car ownership hinders consumers’ ability to get to these stores.

E-commerce, however, is thriving because of growing mobile Internet use, low shipping costs and cheap unbranded products sold online.

The number of packages delivered in China grew to 10 billion in 2014 from just 1 billion in 2006, according to the report.”China’s explosive growth in shipping is an indication that e-commerce is already expanding,” Goldman said, “and has potential to grow even further.”

These trends present “huge opportunities,” according to Goldman, but companies will need to target China’s Urban Mass and Urban Middle to capture them, as well as “align pricing, offerings and other practices to the groups’ specific needs.”