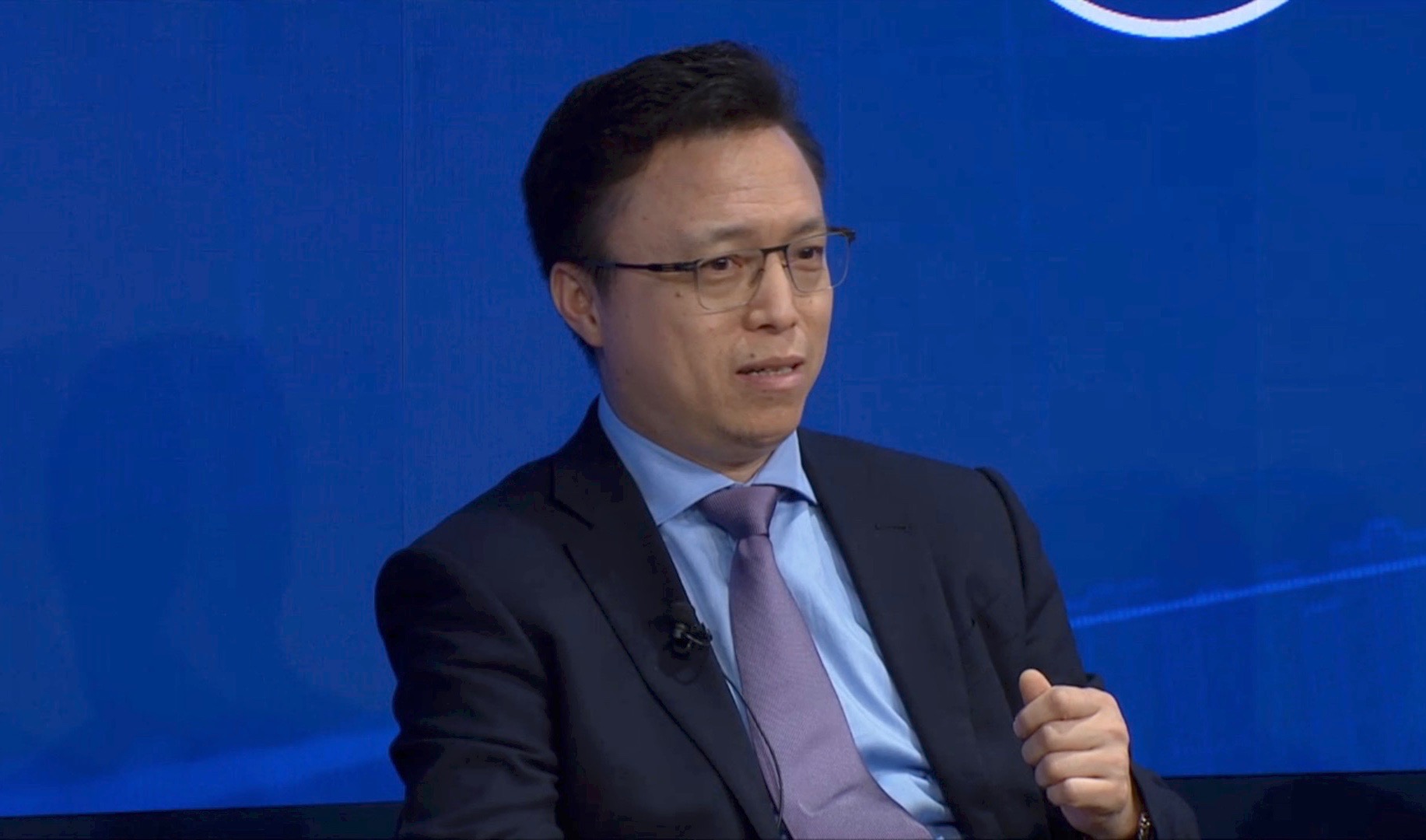

Ant Financial, the affiliate company of Chinese e-commerce giant Alibaba Group, has combined the latest technologies with an emphasis on inclusiveness to bring banking to the people who need it the most, the underserved and the unserved, said CEO Eric Jing on Thursday.

Speaking during a panel discussion on “The Global Fintech Revolution” at the World Economic Forum in Davos, Switzerland, Jing said that technology was catalyzing changes in finance that had extended the sector’s geographic reach and the availability of financial products such as loans to China’s under-banked population. These consumers, as well as SMEs, are now part of the larger finance economy because of advances in fintech, Jing said.

He told the story of Dingri County, the residential area in Tibet closest to Mt. Everest. Before the arrival of Alipay, Ant’s online payments platform, the people of Dingri had to trek miles to get to a bank. It was a starkly different experience than that of consumers in major Chinese cities such as Beijing and Shanghai. Or even so-called second-tier cities such as Tianjin or Chengdu. But thanks to mobile phones, along with cloud computing and big data, people in Dingri could have these basic services delivered to the palm of their hand.

“By having this technology we can really bridge the gap for people in the West [of China] and people in the developed East,” Jing said.

He also talked about how Ant was interested in more than just disrupting the finance sector. Instead, the company sought to work side-by-side with traditional institutions and use technology to upgrade the entire banking system. Watch the video for more on that: