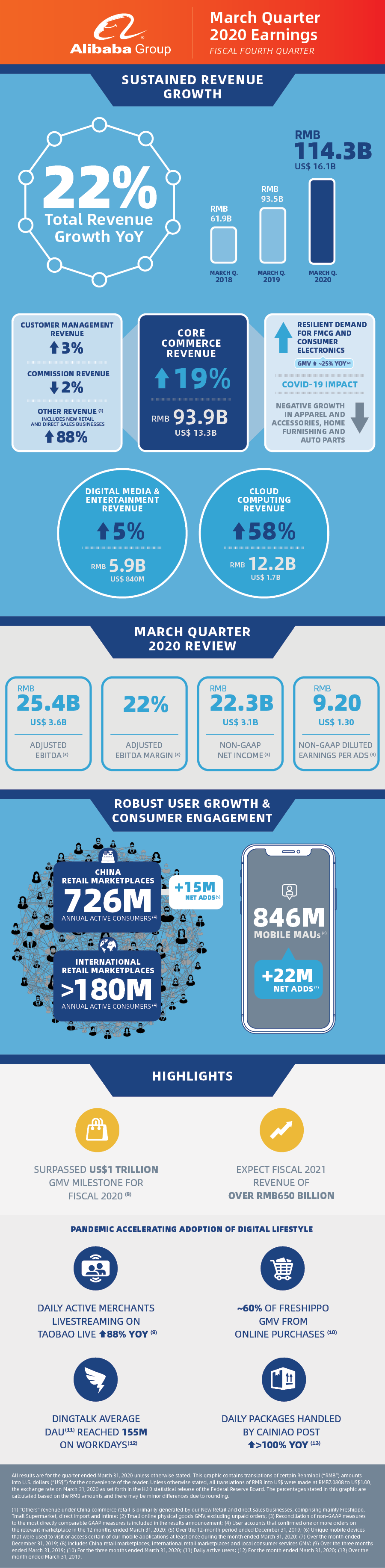

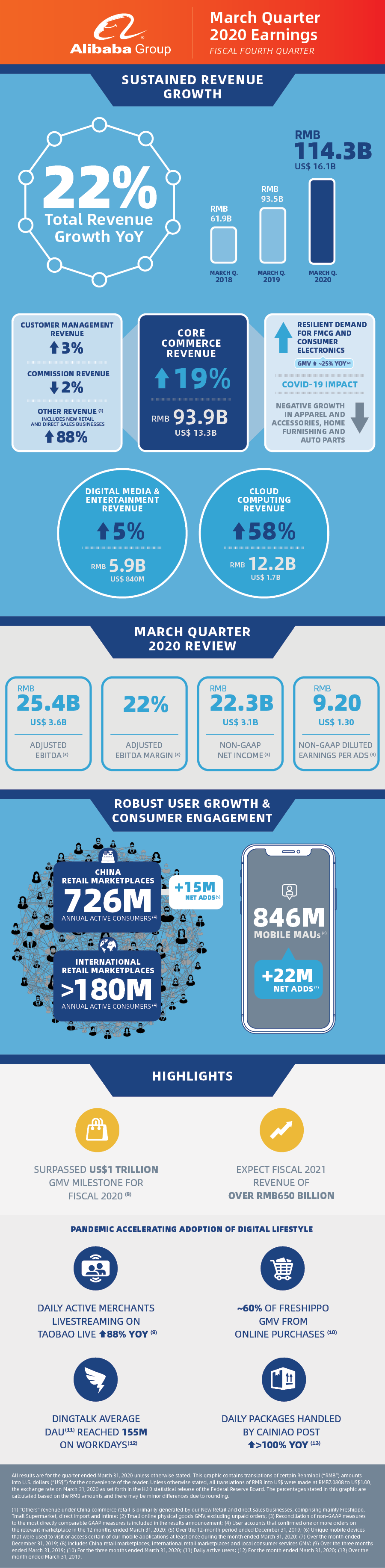

Alibaba Group today announced financial results for the quarter and fiscal year ended March 31, 2020. Highlights are in the infographic and summary below. To read Alibaba Group’s press release covering the results in greater detail, click here.

Highlights

- Surpassed fiscal 2020 revenue guidance, with revenue of RMB509.7 billion, up 35% YoY

- Achieved historic milestone of US$1 trillion in fiscal 2020 GMV across Alibaba Digital Economy

- Total annual active consumer base expanded to 960 million globally

- Expected fiscal 2021 revenue of over RMB650 billion

March Quarter 2020

- Revenue was RMB114.3 billion (US$16.1 billion), up 22% YoY, driven by solid revenue growth of our China commerce retail business and robust cloud computing revenue growth

- Adjusted EBITDA was RMB25.4 billion (US$3.6 billion), up 1% YoY

- Net income attributable to ordinary shareholders was RMB3.2 billion (US$447 million), down 88% YoY, primarily due to a net loss in investment income, mainly reflecting decreases in the market prices of equity investments in publicly-traded companies, compared to a net gain recorded in the same quarter of 2019

- Non-GAAP net income, which excludes the above-mentioned loss and gain, was RMB22.3 billion (US$3.1 billion), up 11% YoY

Fiscal 2020

- Total revenue was RMB509.7 billion (US$72.0 billion), up 35% YoY

- Adjusted EBITDA grew 29% YoY to RMB157.7 billion (US$22.3 billion)

- Non-GAAP free cash flow was RMB130.9 billion (US$18.5 billion)

- Fiscal 2020 GMV transacted in the Alibaba Digital Economy was over RMB7.1 trillion (US$1 trillion)

Resilience in Core Commerce

Continued User Acquisition and Consumer Engagement

- 960 million annual active consumers globally across the Alibaba Digital Economy, including 780 million consumers in China and 180 million consumers outside China

- 726 million annual active consumers on China retail marketplaces, with 15 million net adds QoQ

- 846 million mobile MAUs on China retail marketplaces in March 2020, an increase of 22 million over December 2019 and 125 million over March 2019

- Over 70% of new annual active consumers during fiscal 2020 were from less developed areas

Solid Consumption Growth Despite Covid-19 Impact

- Core commerce revenue of RMB93.9 billion (US$13.3 billion), up 19% YoY

- Tmall online physical goods GMV, excluding unpaid orders, grew only 10% YoY in the March quarter, driven by FMCG and resilient demand for consumer electronics, which together grew ~25% YoY, offset by negative growth in apparel and accessories, home furnishing and auto parts

- However, excluding unpaid orders, Tmall online physical goods GMV saw a strong recovery in April and continue to further improve in May

Covid-19 Accelerated Consumer and Enterprise Adoption in New Business Units

- Accelerated merchant on-boarding: Daily active merchants on Taobao Live (livestreaming) grew 88% YoY in March quarter

- New Retail (grocery category): ~60% of Freshippo GMV during March quarter was from online purchases, up 10 percentage points YoY

- DingTalk: In March 2020, average daily active users reached 155 million on workdays and DingTalk conducted on average over 1 million active classroom sessions on each workday

- Logistics: In March 2020, daily packages handled by Cainiao Post’s neighborhood stations up over 100% YoY

Driving Market Share Gains in Local Consumer Services

- Fiscal 2020 revenue from local consumer services was RMB25.4 billion (US$3.6 billion), up 41% YoY

- Revenue declined 8% YoY during the March quarter, reflecting mass closure of restaurants and local merchants during Covid-19 lockdown, but Ele.me food delivery GMV growth turned positive in April

- During the March quarter, over 40% of new food delivery customers came from the Alipay app

Cainiao Network Value-Add Amplified by Covid-19 Responsiveness

- Cainiao revenue up 28% to RMB5.0 billion (US$699 million) for the March quarter, driven by an increase in fulfilled order volumes from fast growing cross-border and international commerce retail businesses

- In response to Covid-19, Cainiao delivered medical supplies to destinations around the world through its extensive global logistics network of airport hubs, customs clearance operations, trucking companies and local delivery personnel

Building Foundation for Long-Term Growth in International Markets

- Robust growth momentum on Lazada marketplace driven by strong order volume, which increased over 100% YoY in fiscal 2020

- AliExpress delivered robust user and GMV growth in the first ten months of fiscal 2020; GMV growth declined starting in February 2020 primarily due to supply chain and logistics disruptions

- International commerce businesses represented 7% of total revenue in fiscal 2020

Robust Cloud Revenue Growth

- Cloud computing revenue up 58% YoY for the March quarter to RMB12.2 billion (US$1.7 billion)

- Revenue for fiscal 2020 grew 62% YoY to RMB40 billion (US$5.7 billion), primarily driven by increased revenue contributions from the public cloud and hybrid cloud businesses

- Largest cloud computing service provider in the Asia Pacific region measured by market share for IaaS (Infrastructure as a Service) and IUS (Infrastructure Utility Service), according to Gartner (April 2020)

Digital Media and Entertainment

- Youku’s daily average subscriber base continued to grow at a healthy rate, increasing over 50% and 60% YoY during fiscal 2020 and the March quarter, respectively

- Digital Media and Entertainment segment revenue for the March quarter grew 5% YoY, and fiscal 2020 revenue grew 12% YoY

Sign up for our newsletter to receive the latest Alibaba updates in your inbox every week.