What’s the Trend?

China has a nascent plus-size fashion market that is still largely underserved. This presents opportunities for brands to leverage their expertise in this vertical from other markets to fill this white space in the world’s second-largest economy.

How Big an Opportunity?

The estimated consumer base for plus-size fashion in China, which based on the size of the female overweight population given female-focus of this category, is about 36.6 million in 2018 according to Coresight Research. But the demand is growing fast, as Coresight predicted the number could surpass 43 million next year.

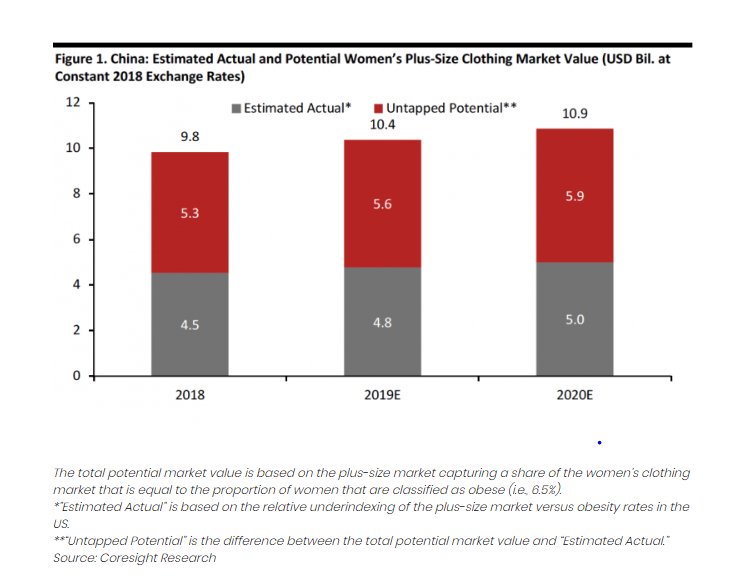

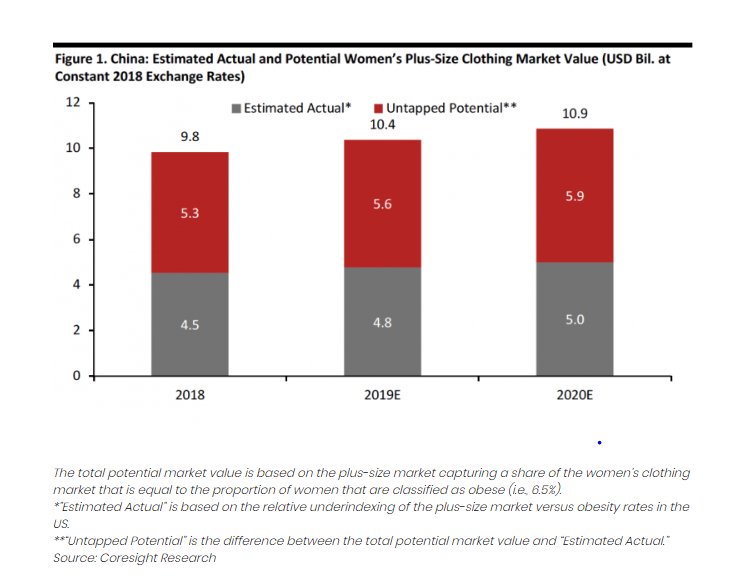

This population is largely underserved. While the size of the overweight populations in the U.S. and China are similar, the actual size of China’s plus-size fashion market is still significantly smaller than that of the U.S., suggesting untapped potential in this area. The size of the plus-size fashion market is estimated to reach $4.8 billion in 2019 for China, while it was already valued at $21.4 billion in the U.S. in 2016, according to Coresight Research and the NPD Group. But the gap is showing signs of narrowing. Coresight has said the Chinese plus-size market could be worth $10.9 billion in 2020.

It is important to note that five billion out of the total $10.9 billion potential market size estimated by Coresight is unsatisfied demand due to the lack of products in the market. In particular, there is significant unmet demand for urban middle-class consumers who want better fashionable options in larger sizes. They are looking for design and fit that would flatter their body shape and make a fashion statement, rather than an extra-large copy of smaller sizes. More so than their American counterparts, curvy Chinese shoppers have a hard time finding dedicated brands and products for themselves. Almost no well-established fashion brands in China offer plus sizes. The options are even more limited in offline stores: Over 90% of stores that offer plus-sizes are old-style neighborhood shops, while well-designed, high-quality plus-size items are hard to find at premium department stores, according to a study by Kr 36, a media and research firm dedicated to startup investors in China.

Factors Driving Market Growth

There are a number of factors that have contributed to the recent rise of the plus-size market in China. For one, ideas about body image in the country are changing. Body positivity is still a new concept in China, but it is starting to generate buzz on social media as the younger Chinese generation becomes more diverse in esthetic standards and celebrates inclusion in fashion. Scarlett Hao, a New York-based, Chinese plus-size influencer who’s known for her highly engaged 180,000 fans on Instagram, started her Weibo and Xiaohongshu (Little Red Book) accounts because, according to her, “I have women living in China asking me every day where to buy the clothes I wear on Instagram,” she said to Jing Daily. For the annual gala on the eve of last year’s 11.11 Global Shopping Festival, Japanese plus-size artist Naomi Watanbe’s performance generated follow-up discussions on positive body images on Weibo.

As the offline options are limited for plus-size Chinese consumers, e-commerce has become the prime real estate for emerging plus-size brands. “Breadth of choice is a major strength of the e-commerce channel, and this strengthextends to specializedapparel segments such as plus-size.The online channelenables shoppersto access niche and specialized brands that serve distinctplus-size consumer sub-segments, such as those defined byage, lifestyle and fashion tastes, whichshoppersmay not be able to find in localstores. In addition to choice,e-commerce gives plus-sizeshoppers theconvenience and discretion oftrying on items for fit at home.” said Deborah Weinswig, CEO of Coresight Research.

A host of e-commerce brands, usually targeting young, urban Chinese millennials, are gaining popularity. Taobao is home to many of them. Muzi Lixiang is a brand on Taobao that has over 900,000 followers and generated nearly RMB 100 million in sales last year. Garden Lis, launched in 2018, is another plus-size brand, targeting plus-size shoppers who are willing to pay a premium for unique design. Its average order value is about RMB 500, or about $80. Within a year of launch, its Taobao store accumulated over 90,000 followers, and it has already expanded to offline stores in Northern China, where historically there is more demand for plus-size fashion than Southern China.

A boom in livestreaming on e-commerce platforms has helped to grow a solid plus-size fashion community, as plus-size shoppers rely more on livestreamers to provide fit information and style tips. With the help of livestreamers, plus-size merchants are able to increase customer engagement and reduce return rates as well. The owner of Muzi Lixiang doubles as a host for her store. She tries on different fashion items and chats about the latest trends and even offers make-up tips to her fans. She is also not shy about showing off her appetite, often making dumplings and eating hotpot while livestreaming. For last year’s 12.12 Taobao Shopping Festival, Muzi Li Xiang hosted a “Frozen-themed” winter wear fashion show on Taobao that attracted 50,000 live viewers and near half a million likes. Dama Wenchuang, a Hangzhou-based incubator for livestream hosts, has successfully coached 23 plus-size hosts with different fashion styles to meet this increasing demand.

The Win for International Brands

As Chinese consumers upgrade their lifestyle, one size will not fit all. Plus-size shoppers will seek out more fashion items that tailor to their needs. That presents opportunities for international brands, such as Lane Bryant, Gwyeenie Bee and Ashley Stuart, that have expertise in the plus-size category in Western markets. They could leverage their marketing, product-design expertise and brand recognition to grow share in the China market. And if China’s plus-size market follows development patterns in the West, we are likely to see more specialized brands that focus on specific areas of the market, such as lingerie, beauty or teens.