Alibaba Group said Thursday it’s targeting revenue growth of 45 percent to 49 percent for the current fiscal year, topping consensus analyst forecasts.

The guidance came from Maggie Wu, Alibaba’s chief financial officer, speaking to investors and analysts at the company’s 2017 Investor Day. In its last fiscal year Alibaba reported revenues increased by 56 percent, but that included consolidation of revenues from investments such as video-streaming site Youku and Southeast Asian e-commerce company Lazada. Without those additions, Wu said, last year’s growth would have been 44-45 percent.

What happened during Day Two of Alibaba’s investors’ summit? Find out here.

The strong growth projection was a reflection of a combination of factors, among them the resilience of Alibaba’s core Chinese e-commerce business, continuing healthy spending by Chinese consumers, user growth as well as contributions from new revenue streams coming from investments and initiatives that are having an impact on Alibaba’s top and bottom lines.

The company continues to evolve beyond its China e-commerce roots by moving into digital media and entertainment, cross-border e-commerce, local services, digital marketing and other areas, Chief Executive Officer Daniel Zhang told investors on the first day of the two-day gathering in Hangzhou, China.

The best way to understand the 18-year-old company and its seemingly disparate businesses—Alibaba also runs China’s largest public cloud service provider, a movie production and distribution business (Alibaba Pictures), and has invested in several retailers—was to think of it as an economy unto itself, Zhang said.

“Today we have half a billion customers around the earth, we have close to 10 million small business transacting on our platforms every day, we are now moving into new areas like digital entertainment,” he said. “Together with all the partners, all the participants in the ecosystem—buyers, sellers, service providers, content providers–all together we constitute a real economy ‚Ķ if you look at the components of this economy, you see a very clear picture and very big synergies across these platforms, each of these business sections.”

The evolution of the company from pure e-commerce operation to a content-rich, digital-marketing “ecosystem” is changing the way analysts should assess Alibaba’s performance. Wu unveiled a new calculus that Alibaba uses to measure its so-called “take rate” from merchants and brands, saying you have to look beyond gross merchandise volume and revenue to see the broader value proposition the company offers.

“We are not just simply a distribution platform, nor a marketing platform. We provide mixed value, broader value and also transform the way business is being conducted in China,” she said. Customer service and other value-adds need to factor into the take rate, because Alibaba is far less reliant for cash flow on taking a percentage of every purchase made on its marketplaces, she said.

Meanwhile, the company’s massive amounts of data on consumer behavior and sales trends is giving merchants greater ability to find, engage with and foster relationships with consumers, Wu said. Consequently, the company is renaming a metric called “online marketing revenue” to “customer management revenue.”

“We are enabling merchants and brands to manage the consumer during their entire life cycle, from when they became aware and interested in products, then purchase and into loyalty. This represents the real business value we provide to our customers,” Wu said.

Alibaba will also start referring to “annual active consumers” instead of “annual active buyers” to reflect that Alibaba users are participating in the company’s ecosystem in a variety of ways, not simply purchasing merchandise.

“Nowadays, we see more and more people are consuming content, services, lifestyle kind of products on our platform,” Wu said.”By changing that name, it gives us, later on, the same kind of terminology to describe the growth of our other businesses, like the entertainment business.”

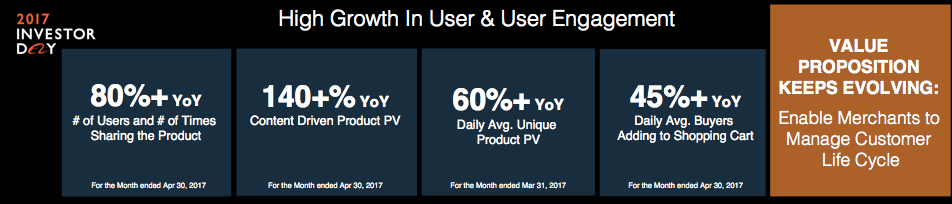

Alibaba is expanding user engagement through content such as live-streamed videos highlighting new products. The number of users sharing content, and the number of times a product page is shared, grew 80% YoY in April. Content-driven product page views meanwhile increased more than 140% YoY.

Wuadded Alibaba’s original guidance of 48 percent revenue growth lastJunewas on the low side in part because the company underestimated theimpact on revenues of new “relevant” content and new Alibaba technology such as marketing software that allows merchants to offer highly personalized pages to individual customers.

“We did not really factor in all of these developments and growth in content and data technology,” she said “It grew very fast and even exceeded our own expectations.”

As for this year’s FY 2018 guidance forecasting revenue growth of 45 percent to 49 percent, Wu said:”We have …confidence. The data, the technology we have, the whole integrated business we have built, we’re going to achieve that.”

Other important takeaways from the first day:

- Alibaba Cloud has recorded eight consecutive quarters of triple-digit growth and is approaching profitability. But Wu said profitability is still not a top priority as the company continues to emphasize customer and market growth.

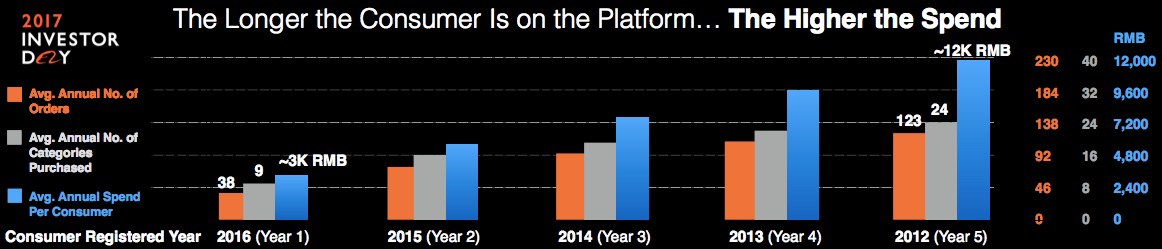

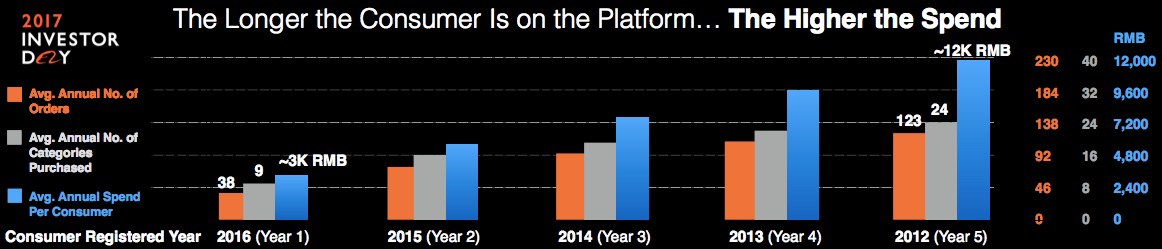

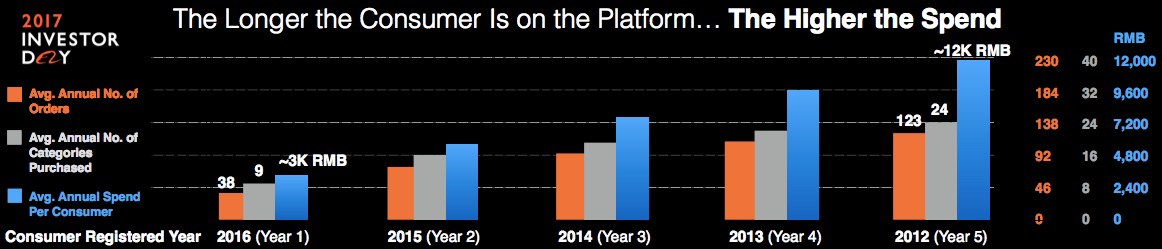

- The longer Chinese consumers use Alibaba platforms, the more they spend. The average customer placed 38 orders in the first year of registering on an Alibaba shopping site; four years later, they placed on average 123 orders. The average number of categories purchased meanwhile rose from 9 in Year 1 to 24 in Year 5. Average spending per customer rose from around RMB 3,000 in the first year to more than RMB 12,000 in the fifth year.

- Alibaba is a leader in multiple business areas, not just core commerce – something that’s sometimes overlooked by the investment community. “People might not fully appreciate it that we are the business leader, not only in the core commerce, or the cloud,” Wu said.”We are the business leader in so many business areas. We are not only theNo. 1in e-commerce.”

- Jet Jing, vice president of Tmall, noted that the business-to-consumer site has become an engine for what Alibaba calls “quality consumption.” That refers to the upgrade in shopping currently being seen in China’s expanding middle class. Where those consumers once spent their money on staple items – and discounted ones at that – this key demographic increasingly wants high-quality goods and often from international brands. In short, they’re willing to pay more money for better products and services. “For example, the purchase of high-end personal care products in May was nine times higher than that of the category average year-on-year. In beauty care, it was 2.59 times, and the number was 1.8 times for infant formula. So in all these categories, we are seeing a lot of speed and that attract the best players in the world,” Jing said.

- Wu said Alibaba in the last fiscal year generated free-cash flow of $10 billion. “Where are we going to invest that money? We are going to invest that to gain B2C market share,” she said.”This is a company that always invests for the longer term, for the future.”