(This is the second in a four-part series examining three megatrends that are driving consumer spending in China)

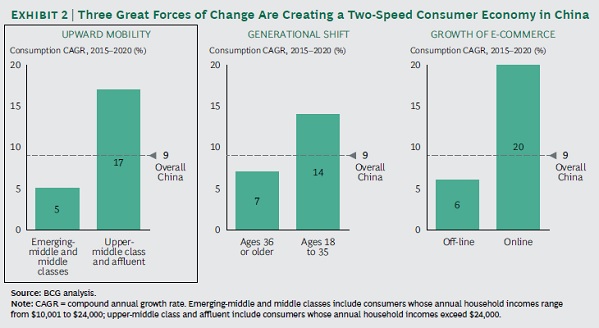

According to management advisory firm Boston Consulting Group, China’s economy is struggling through a difficult structural transition and consumption isn’t rising as quickly as it did during the country’s boom years. “But make no mistake,” BCG researchers wrote in a recent report, “although the pace is slower and the course is bumpier, consumption growth is still tracing a staggering trajectory.” Annual consumer spending is projected to reach $6.5 trillion in 2020, BCG researchers wrote, driven by rising incomes, more free-spending youth and the spread of e-commerce.

First among these drivers is the growing number of upper middle class and affluent households, or those with more than $24,000 and $46,000 in annual disposable income, respectively. This group of super spenders is expected to see its population double over the next five years to 100 million households, and as an economic force they are poised to eclipse the impact of rising but less-wealthy consumers: Their consumption is currently growing at 17 percent a year, compared to just 5 percent among emerging-middle-class and middle-class consumers. The acceleration of spending among this richer middle class, while that of the other middle-class constituents decelerates, has created what BCG calls a “two-speed consumer economy” in China.

Spending by upper middle class and affluent households is expected to account for 81 percent of China’s incremental consumption growth from 2016 through 2020. This won’t be the same kind of spending behind so much of China’s expansion in recent decades, either. Wealthier consumers will increasingly favor services such as healthy foods, education and travel over staple goods such as personal-care products.

And these sales will take place in smaller, less known metropolises. BCG said about half of the 46 million new upper middle class and affluent households expected by 2020 will be located in fourth-tier cities or lower, or those outside China’s top 100 cities. That means if companies want to reach 80 percent of this key demographic, they’ll need to establish a presence in as many as 430 different cities.

To readother installments inour series on the three trends driving China’s consumer economy through 2020, click hereand here.