Tmall this year will work with top beauty brands such as Estee Lauder and Lancome to help them cross RMB 1 billion (US$157.9 million) in annual sales on the platform, as well as deliver an updated suite of New Retail solutions so that all merchants can better serve Chinese consumers, the Alibaba Group-owned B2C shopping site said on Sunday.

Tmall plans to partner closely with about 10 beauty brands in particular, including also SK-II and Olay, to help them break that sales threshold. New Retail initiatives include a new “try-before-you-buy” feature, where users pay a 10% deposit to test a product with the promise of a simpler and faster refund process.

“Our partnership with brands will cover every corner from online to offline,” Tmall President Jet Jing said. “We will be consistently involved in daily operations ranging from product innovation, brand building, channel management, supply chain to customer operations.”

Tmall Supermarket would also expand its one-hour delivery service to more customers, as faster service is also a part of New Retail, Jing said. However, the biggest changes won’t come until the 11.11 Global Shopping Festival, which is typically when Alibaba rolls out its New Retail initiatives.

The initiatives were announced during the Tmall Beauty Awards in Shanghai, where over 1,000 beauty professionals, from both international and home-grown brands, gathered for the annual event. This year, Estee Lauder, SK-II, Giorgio Armani Beauty and Givenchy each took away a “Super Brands Award,” for their outstanding performance in brand influence, marketing creativity and consumer engagement. Newcomer Givenchy on March 1 broke the single-day sales record, selling more than 58,000 lipsticks and generating over RMB 16 million—all in the first 12 hours of the day.

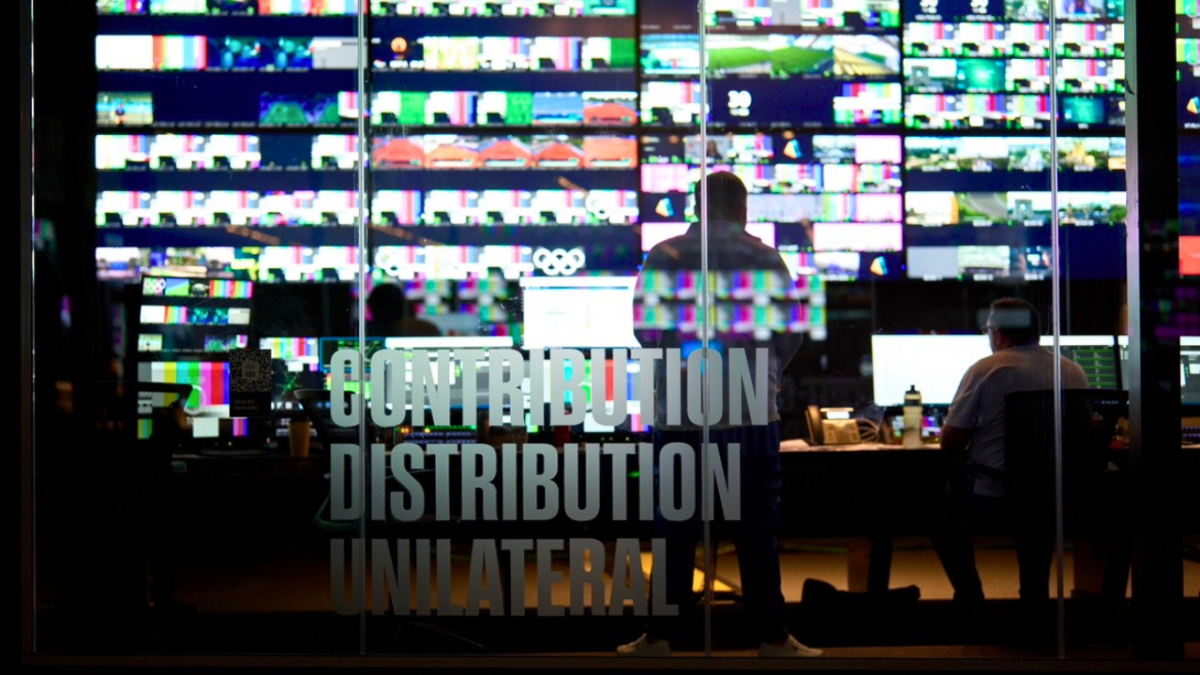

WATCH:’New Retail’ Still Top Trend at Tmall Beauty Awards

Since launching in 2015, the awards largely have spotlighted New Retail-driven innovations. Featured technology at this year’s awards included the “Cloud Shelf” and the latest iteration of the augmented reality-powered “Magic Mirror,” which allows users to virtually try on new hairstyles, lipstick, eyeshadow and blush. Tmall said it would partner with with French cosmetics company L’Oreal to install Magic Mirrors in 50 of the beauty giant’s physical stores in China.

Tmall hosts more than 3,000 beauty brands on its platform, according to a report released by Tmall and Chinese research firm CBNData last year. Some of the newest entrants include LVMH-owned Givenchy, L’Oreal’s Giorgio Armani Beauty and Estee Lauder’s Darphin.

“After two years of very successful acceleration in China, we felt this is the right timing to join Tmall to push artistry and premium-ness of the brand,” said Andrea Yann, general manager of the China market at Giorgio Armani Beauty. “Our plan is really to understand from [Alibaba’s] database what are the main beauty concerns of Chinese women to solve t heir beauty issues, be very personalized still being [seen as] very artistry and premium.”

Younger, More Focused on Beauty

According to a report released Sunday by Tmall and market research consultancy Kantar, what they want is a more elaborate skincare regimen. Thirty-five percent of respondents said they have added more steps to their beauty routines, and therefore are spending more on skincare products and cosmetics. Tmall attributed 53 percent of the sales of beauty products on Tmall to consumers making more purchases per person.

Beauty consumers in China—the world’s largest and fastest-growing beauty market at $22 billion—are also becoming younger than ever, the report noted. In 2017, users born after 1990 made up over 40 percent of shoppers on Tmall Global, the site’s cross-border e-commerce channel, overtaking those born in the 1980s as the main consumption force on Tmall Global, the site’s cross-border e-commerce channel. Consumers born after 1990 like to try new products from new brands and less familiar origin countries, the report said.

Embracing the New

“In China, there’s more willingness to try new products at a faster rate than what you would see in different markets,” said Danielle Bailey, head of Asia Pacific research at digital agency L2.

“It’s not that [Chinese beauty consumers] are less loyal, but their desire to explore is much higher,” she said. “This makes it more challenging for brands to sell to the market, but also creates new opportunities.”

Tmall’s latest report also showed momentum for homegrown brands, particularly for skincare, where they accounted for 56 percent of sales last year—up from 54 percent in 2016. However, foreign brands still dominate the cosmetics category with 56 percent of total make-up sales.

Chinese brands are trying to boost their profiles by launching new prestige product lines or creating new products within an existing line, said Bailey. “It will be interesting to see if local brands can successfully transition to that space. It’s still a bit unclear because Western brands tend to be associated with better quality,” she added.

From a product development standpoint, the pace of innovation in Asia has forced brands in the West to shrink development timelines to stay relevant, said Bailey. Where Western companies may take two years to release a product,” he said, “in Korea, some brands are launching new product every three months.”

Time-to-market is indeed very important for beauty brands, said Ye Guohui, general manager of Tmall’s new retail division.

“Conducting market research alone can be very time-consuming, taking up to over a year,” he said. “But brands in China can leverage Alibaba’s data capacities to really shorten that timeline, and accelerate product development.”