The real story behind Tmall’s 40 percent headline growth last quarter is how it’s underpinned by big changes in merchant-customer relationships and a resulting healthy shift in consumer-consumption patterns, says platform Vice President Jet Jing.

Speaking to investors at Alibaba’s 2017 Investor Day last week, Jing emphasized Tmall’s ability to remove much of the friction between platform and merchant and merchant and consumer, leading to both more and higher-quality consumption.

On the brand and merchant side of the equation, Tmall’s strong top-line business growth “is a foundation to allow us to tell and share with our partners why [it] is the best place to generate the growth for their China growth, which is a critical part of their global growth strategy,” he said.

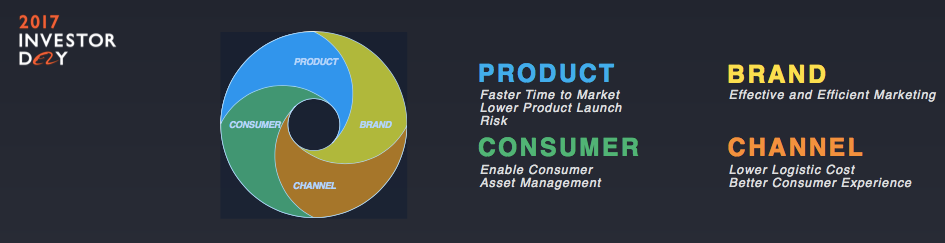

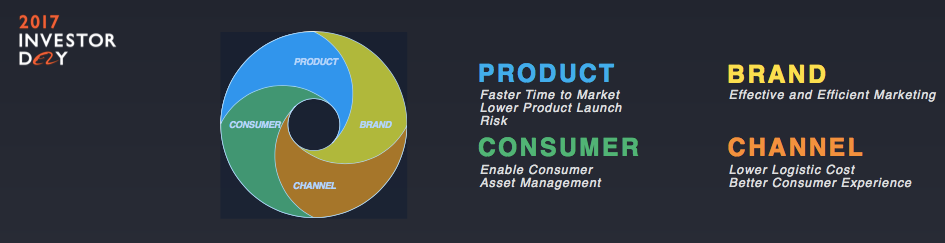

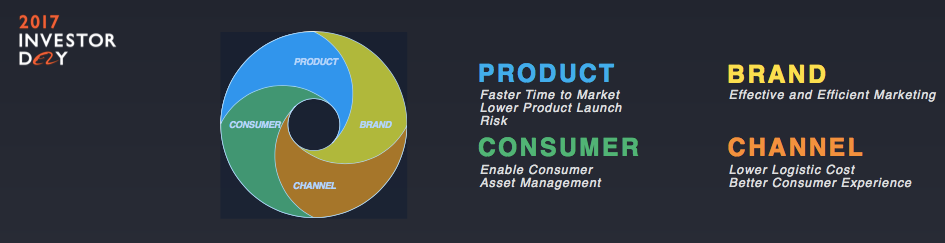

Armed with data and information supplied by the platform, brands are moving beyond thinking about how many pieces they moved last month to a higher level of understanding about their customers and what is happening between the consumer and the brand’s product in near real-time. In essence, Tmall’s data tools remove a lot of the guesswork and the inventory uncertainties and make experimentation easier and less-risky and their businesses more efficient.

As testament to the power of data, he noted in his presentation that 75 percent of the consumer brands in the Forbes Top 100 Most-Valuable Brands are on Tmall. And they’re in a strong position to tap the growing spending power of Chinese consumers, who are increasingly looking upmarket for more-expensive and higher-quality merchandise.

“Tmall is a quality consumption-upgraded engine from a consumer standpoint. So, we need all the brand companies to more fearlessly launch the new products, launch the new innovation to serve our consumers. That is a win-win solution for everybody,” Jing said.

Brands experience faster time to market, more-effective marketing campaigns, lower logistics costs and ultimately, a better consumer experience, he said.

“You know how they respond to your product to your pricing, to your promotion, to your communication point, even to how frequently they may use your product,” Jing said. “So, you will get a much better sense before you push the button for national launch‚ĶNobody in history and nobody anywhere outside of China, outside of the Alibaba ecosystem, can do that for a brand company.”

Jing spoke at length about the campaigns and marketing opportunities Alibaba platforms hold throughout the year. While they are a strong opportunity to generate sales, the important takeaway is that “each festival deliberately designed by Tmall is not solely a promotion. Every festival is a moment to organize all the brands together to upgrade the consumption level of the consumers of Tmall,” he said.

“So, each festival, we continue to raise the bar about which product, which brand can get into this festival, can meet with the consumers, not just meeting the demand, but creating and leading the demand upgrade,” Jing said.

And it’s working. Aspirational Chinese consumers are increasingly buying what the platform refers to as “super-premium” products, a segment growing faster than others on Tmall, he said. In 18 seconds, for example, Maserati last year sold 100 cars with no special promotion, no price reduction — a sign of the brand equity the automaker has built up with Chinese consumers on Tmall through its prior and regular interactions with them on the platform.

“That is showing the unique power of Tmall. In today’s China economy, we know there may be challenges overall, but the quality consumption trend is inevitable especially to the consumers who are desiring a higher quality lifestyle and who are waiting to pay money to the better product and also better service,” Jing said.

On the consumer side, other value-added services Tmall offers brands are helping a consumption upgrade. Tmall’s”beauty advisor” service, for example, lets consumers from anywhere in China to interact, learn and trywithout limits tounderstand why and how a premium beauty product is right for them.

“That redefines the time required for a brand to get consumer buy-in, and it has redefined the boundaries for any physical location limitations,” he said.

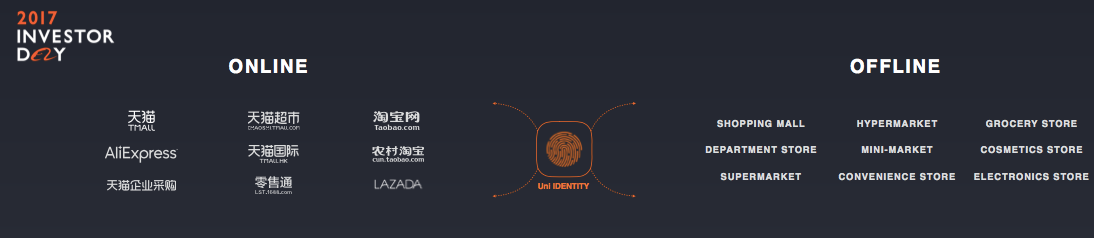

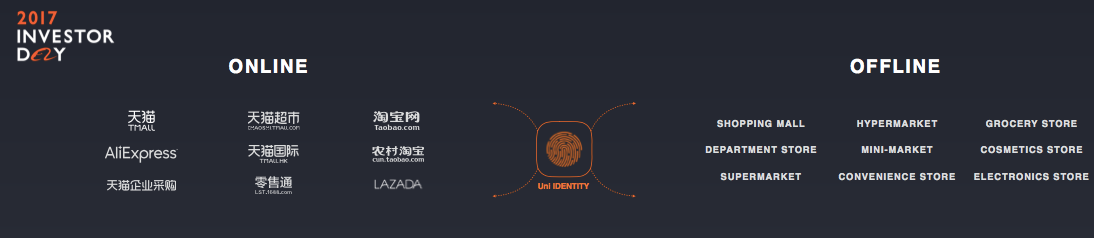

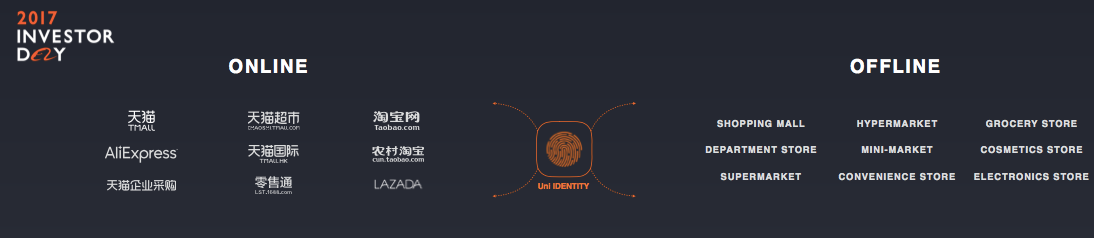

Tmall is also helping brands improve the consumer experience by improving the integration of their online and offline operations — part of Alibaba’s efforts to drive what it’s calling “new retail.” Specifically, Tmall is headed in the direction of enabling merchants to offer a single inventory supply to online and offline customers.

“Just think about how much that can save and minimize out-of-stock issues for any brand or company,” he said.

The idea is to make the experiences online and offline similar and allow the customer to place an order online, but pick the product up offline — from a store or locker, for example — or receive a product sent from an offline outlet that already has stock.

Jing said Alibaba envision the day when it can help redefine the retail format for small stores in top- and lower-tier cities in China, in the rural parts of the country, in supermarkets.

“We will be able to help the brand and company to reorganize all of their sunk investment in all these places and turn everything into a solution for gaining more consumers and optimizing every consumer fulfilment cost, end-to-end,” Jing said.