Alibaba Cloud, Alibaba Group’s cloud-computing business, is increasingly being recognized as one of the up-and-coming competitors in the global public cloud-computing market.

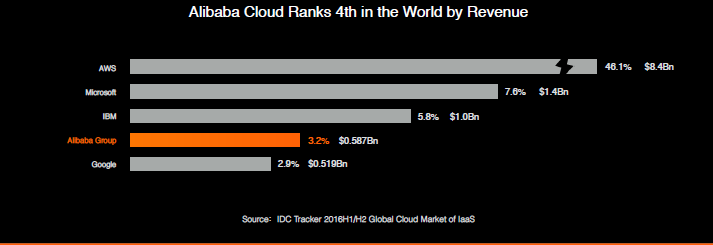

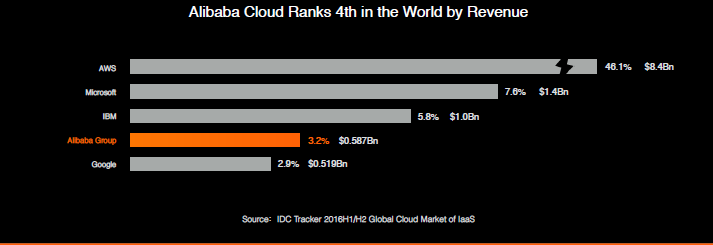

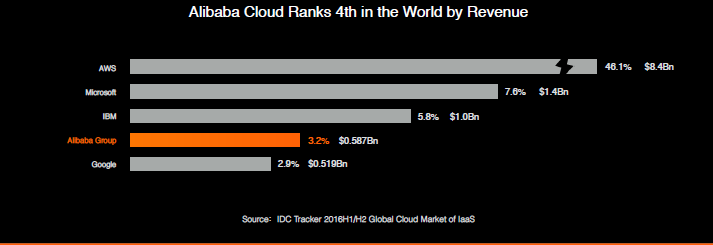

Alibaba Cloud may berelatively new to international markets, but it is well positioned to compete with bigger players such as Amazon, Microsoft, and Alphabet’s Google, according to a recent report from influential IT research group Gartner. The companywas ranked by Gartner at No. 4, ahead of IBM, Oracle and others, in terms of its ability to execute.

This is the first time Alibaba Cloud has been mentioned in Gartner’sannualreport,entitled “Magic Quadrant for Cloud Infrastructure as a Service (IaaS) Worldwide,” which assesses global cloud service providers’ relative strengths and ranks them in four categories: market leaders, challengers, niche players and visionaries.

Alibaba Cloud was placed in the visionaries section, alongside Google, IBM and Oracle, a demonstration of Gartner’s recognition of Alibaba Cloud’s strong performance in cloud IaaS in China and its growing investment in new markets. “In China, Alibaba has built an impressive ecosystem consisting of managed service providers and ISVs, and it has begun to attract a global ecosystem to its international offering.” wrote Gartner analysts in the report.

Analysts added the company hasa diverse set of capabilities which “today are already comparable to the service portfolios of other hyperscale providers,” demonstrating “the vendor’s potential to become an alternative to the global hyperscale cloud providers in select regions over time.”

At Alibaba Group’s Investor Day event on June 8-9, Alibaba Cloud President Simon Husaidthat his company is just getting started. In a 45-minute speech, Hu explained in detail growth strategies and ticked off accomplishments underscoring Alibaba Cloud’s momentum:

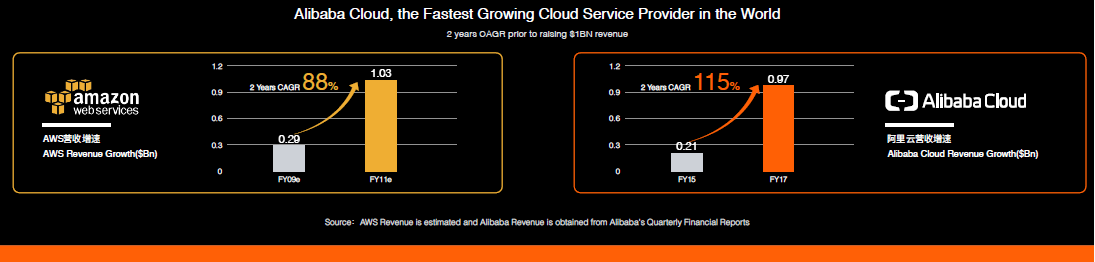

- Alibaba Cloud has maintained triple-digit revenue growth for eight consecutive quarters, according to IDC.

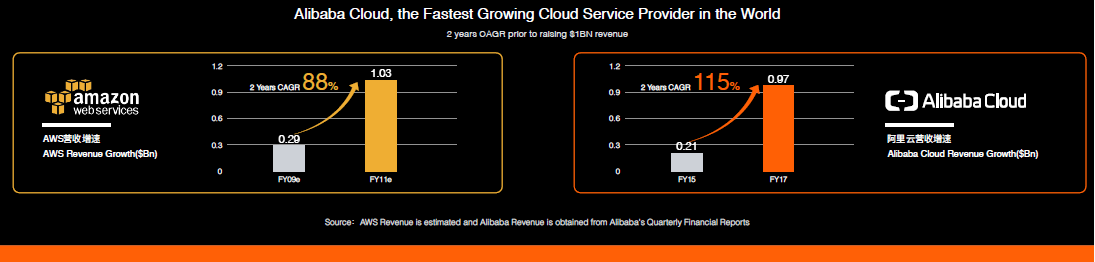

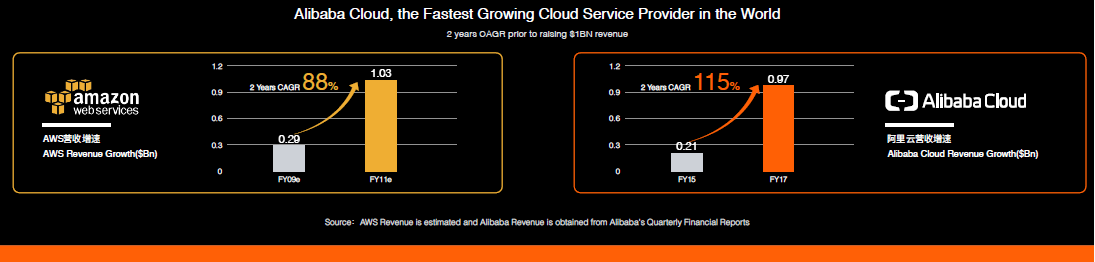

- Annual revenue is now more than $1 billion. When Amazon’s market-leading AWS cloud service surpassed the $1 billion mark, it was growing at 88% a year, Hu said. Alibaba Cloud is growing faster at the same point, at a CAGR of 115%.

- In China, Alibaba Cloud has a dominant 40.7% market share. Revenue is roughly equal to the next seven competitors in China combined, including AWS and Microsoft.

- Alibaba Cloud now as more than 870,000 customers and 15 data centers around the world. “We have customers in the United States, in the Middle East, across Asia and Japan, so we are truly serving a global marketplace,” Hu said.

- More than one-third of China’s top 500 companies and about two-thirds of China’s “unicorn” companies are using Alibaba Cloud, according to Forbes.

Fast growth in China’s cloud computing market, as well as advances the company is making in the application of artificial intelligence to analyze large amounts of data, “is presenting us with many opportunities for rapid growth,” Hu said.

The company’s overall vision is not only to provide basic infrastructure such as data storage and computing capability via the cloud. Companies, governments and other organizations in China and around the world are making a digital transformation to reduce costs and improve productivity. Alibaba Cloud is positioned to help drive this transformation by providing cloud-based solutions and software services targeted at specific enterprises.

“More and more companies want to have rapid access to data and to decision-making in a mobile office environment, and they can leverage a lot of Alibaba Cloud technologies and services,” Hu said.

The company has already developed 186 vertical solutions aimed at different sectors to help traditional enterprises upgrade and complete their digital transformation. Customers are broadly spread, coming from government, finance, manufacturing, healthcare, traditional internet industries such as social media, and even the Beijing Winter Olympics 2022. Alibaba Cloud is also one of the top-ranked providers of enterprise-class data security solutions.

“For the next 10-plus years, we fully expect to continue to maintain a rapid pace of growth because we see the demand in the market and the opportunities in the market,” Hu said. The question is what Alibaba Cloud can do “in terms of our technology to provide a deeper level of service,” he said.

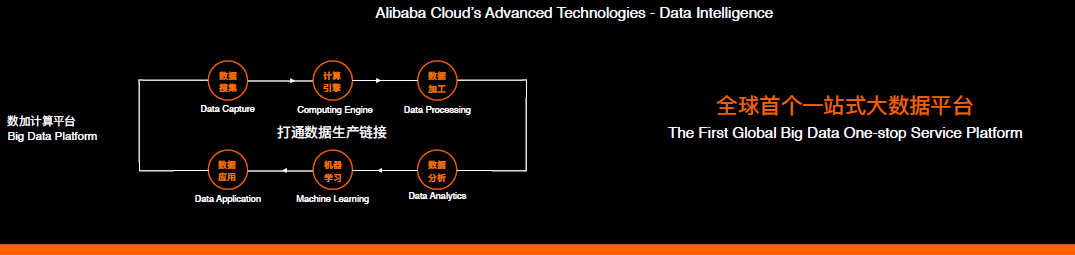

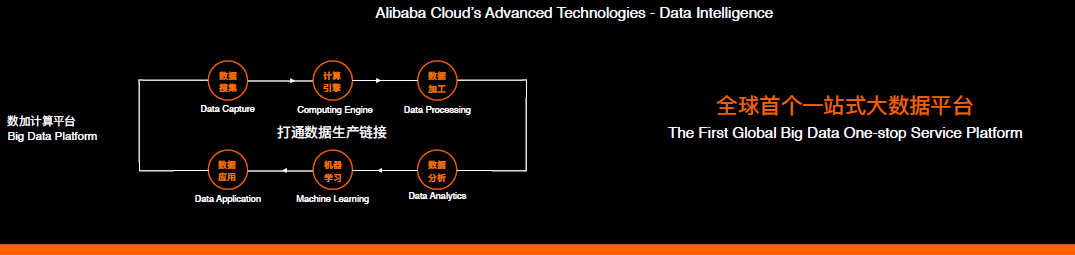

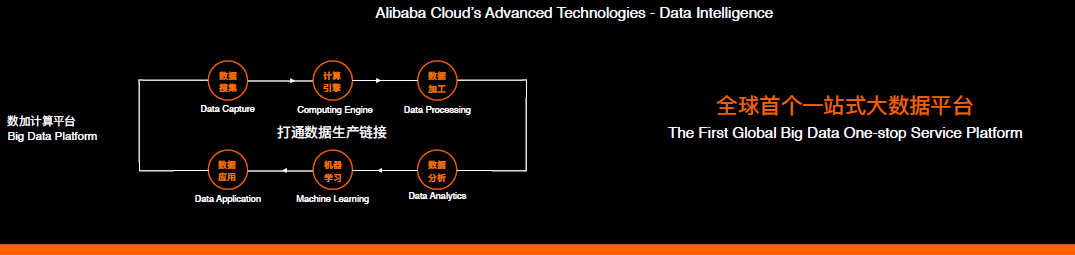

Over the past year, data intelligence has become the most important strategy for Alibaba Cloud, Hu said. The company has unveiled a big data intelligence platform that offers one-stop service for data processing and analytics. “This is the first global big data one-stop service platform and it is increasingly being adopted by more and more enterprises,” Hu said.

Alibaba Cloud is also moving aggressively into artificial intelligence-based services. The company is harnessing this nascent technology to improve the speed and efficiency of gaining useful knowledge from large amounts of raw data—as well as to create entirely new applications and solutions.

“Alibaba Cloud and the Alibaba Group has 10 years of experience with (AI) algorithms,” Hu said. “Adding that to our cloud capability, to our video and image processing capability, we are able to leverage on that to quickly develop new kinds of artificial intelligence-based services.”

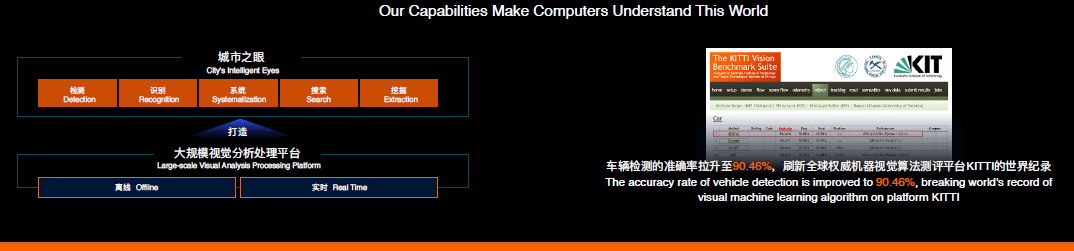

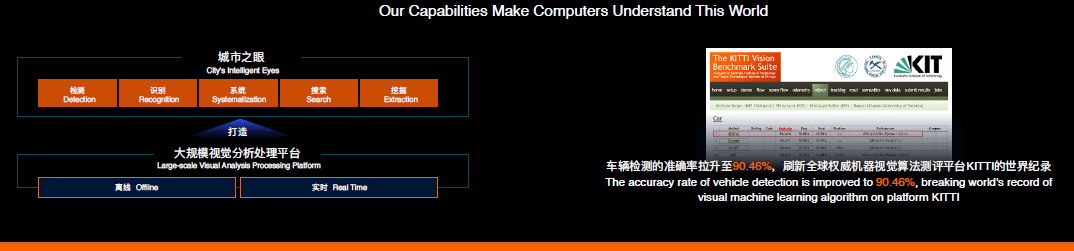

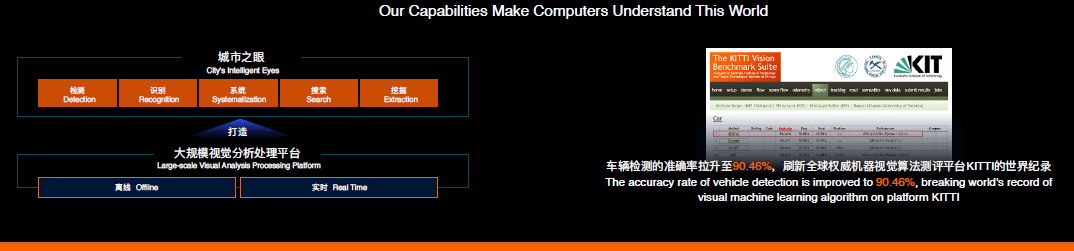

Hu offered as an example Alibaba Cloud’s work in AI technology for video images captured from traffic cameras in the city of Hangzhou, China, to optimize traffic flow. “Traditionally you needed to have humans to monitor the images being captured by the camera,” He said. “This is a huge opportunity for automation. There is no way that a human operator looking at traffic cameras can tell you where the congested road segments are and how to optimize city traffic.”

Alibaba Cloud has developed AI software that can determine and capture the makes of vehicles, license plates, speed and direction of travel. With an accuracy rate of 90.46%, the software in May broke the world record for visual machine-learning algorithms, based on an international test called the KITTI Vision Benchmark Suite.

Alibaba uses the system to regulate the duration of traffic lights, increasing traffic flow by 11%. It can also spot traffic accidents and reduce police response time from 15 minutes to three minutes.

“We are developing the capability not to go and take part in chess competitions or Go competitions,” Hu said. “We are developing technology to solve real-world problems.”

Alibaba Cloud’s future looks bright in part because there are so many real-world problems to solve. Hu said he sees a lot of potential business coming from traditional Chinese companies in financial services, manufacturing and healthcare that are ripe for digitalization. China’s vast manufacturing sector wants to transition to smart manufacturing to gain greater supply chain control, yet just 1% of manufacturers have cloud capabilities today, he said.

“That’s going to go up fast,” Hu said. In addition, “many retailers want to be selling offline and online and do omni-channel marketing, this is another big opportunity for us.”

Hu cited TCL, one of the largest manufacturers of TV panels in China, as an example. With RMB 24 billion in annual revenue, “they were not capturing and getting value out of their data,” Hu said. Alibaba Cloud helped the company use data to adjust its manufacturing processes, enabling TCL to decrease the production of defective panels by about 1%.

“That directly translates into an increase of RMB 240 million in net revenue for the company each year, driven by our ability to analyze their data,” Hu said. “So, huge commercial opportunities there.”

Asked which company is Alibaba Cloud’s biggest competitor in China, Hu said the market will ultimately exceed $100 billion. Today, “AWS and Alibaba Cloud are both small in that context,” he said. “So, our biggest competitor is ourselves, and the challenge is to what extent we can continue to rapidly innovate in our technology and continuously leverage on data intelligence as the core means for creating value for enterprises.”

Globally, “AWS is still bigger than us, but we have been chasing them for two years. Two years ago, they were 30 times bigger than us. Today AWS is probably around10 times bigger than us, but we are growing faster than AWS and I think going forward we are better positioned.

“So, five to 10 years from now, we still think our biggest competitor will be ourselves,” Hu said.”The challenge is to continually innovate–that is at the core of what we do.”