Photo credit: Getty

Alibaba Group Holding’s fourth-quarter profits beat Wall Street analysts’ expectations as multiple business units curbed losses.

During the quarter ending March 31, losses narrowed year-over-year at Alibaba’s value-for-money platform Taobao Deals, community marketplace Taocaicai, Local Consumer Services, and at the Digital Media and Entertainment business.

Adjusted EBITDA, a non-GAAP measurement, jumped 37% year-over-year to RMB32.12 billion ($4.7 billion) for the quarter, beating consensus forecasts of roughly RMB30 billion compiled by Bloomberg and Refinitiv. The platform company has topped quarterly profit forecasts consistently for over a year, largely by controlling costs, said sector analysts.

Diluted earnings were RMB9.00 per American Depository Share (ADS), above consensus estimates of RMB5.61 and RMB5.16 by Bloomberg and Refinitiv, respectively.

“In an increasingly complex world, we have proactively transformed our organization to strengthen the competitiveness of our businesses through greater independence to address the evolving needs of different customers and capture new opportunities,” said Alibaba’s Chairman and CEO, Daniel Zhang.

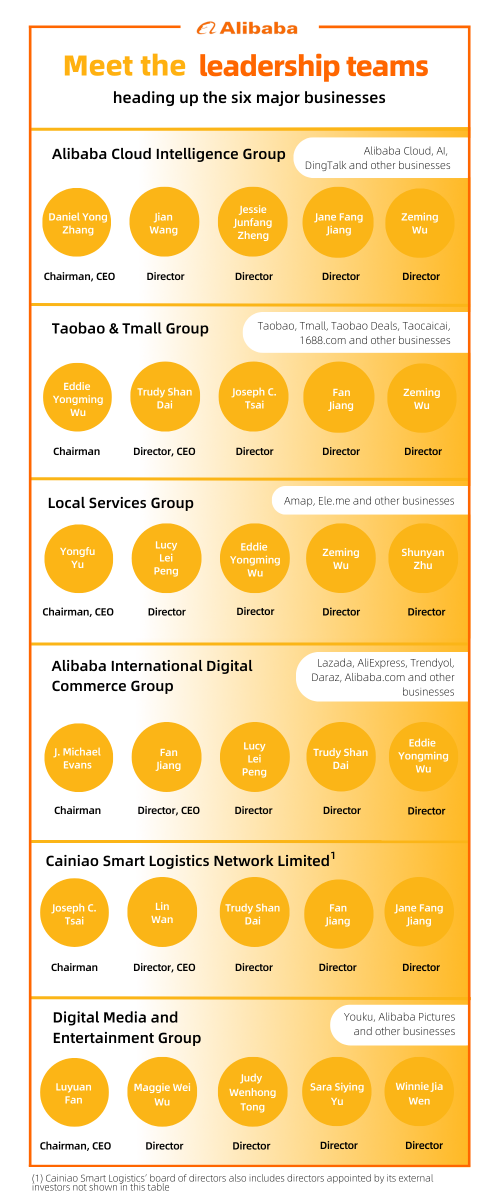

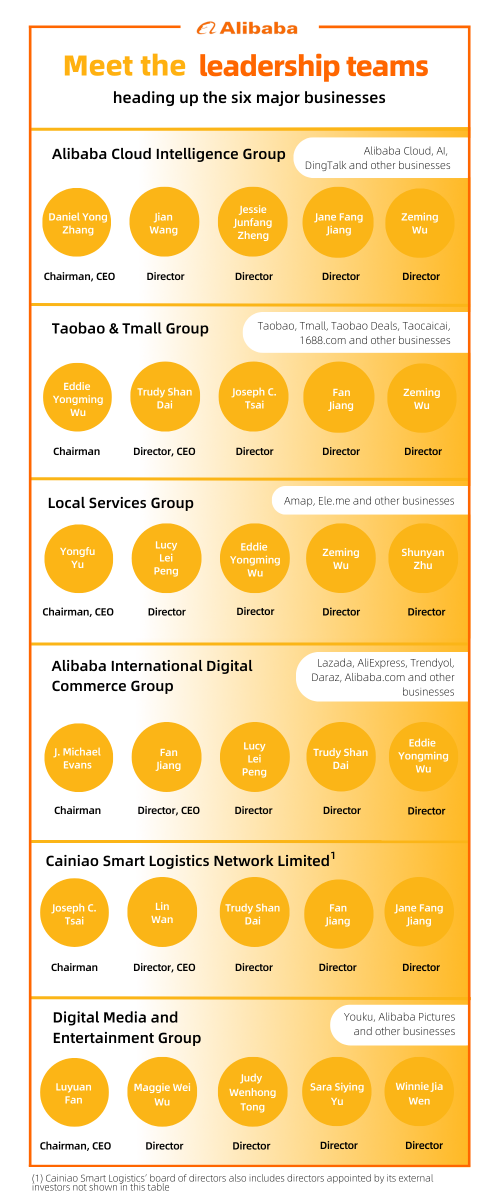

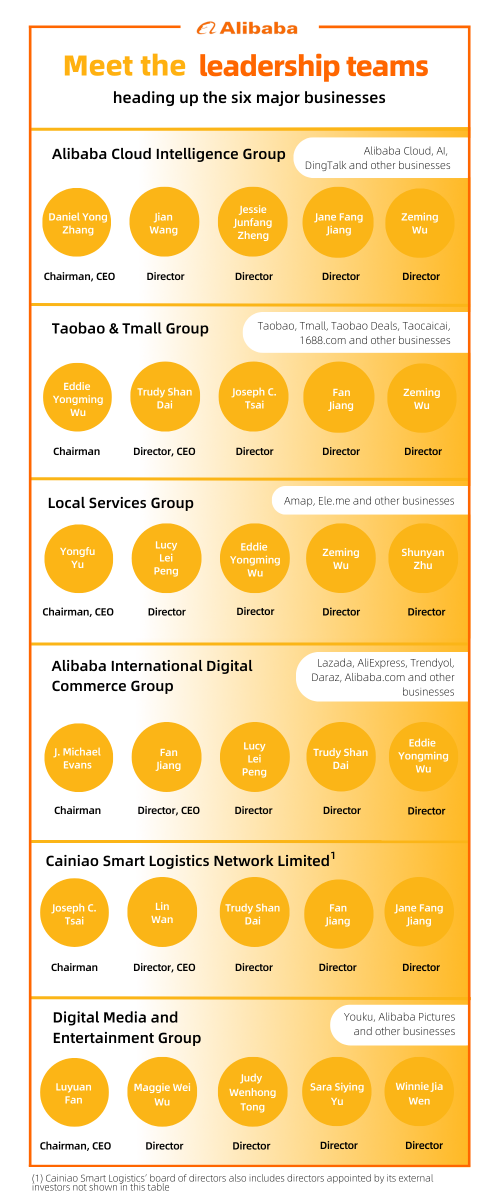

Stock analysts expect this laser focus on profitability to continue after Alibaba unveiled its biggest-ever restructuring in March. At the time, Alibaba said it would reorganize itself into a group holding company, plus six major business groups and various other investments.

Each business is free to pursue an initial public offering. With this self-determination comes the financial discipline of capital markets. Alibaba’s Chief Financial Officer Toby Xu told analysts on a call that except for Taobao & Tmall, businesses and other subsidiaries have been given a limited time to access Alibaba Group’s capital, including equity injections and credit facilities. After that expires, each business should finance itself by various means, including raising private equity, issuing debt and becoming publicly listed. Click here for details of the IPO plans

Green Shoots Of Recovery

Competition remained fierce across the world’s biggest e-commerce market, and logistics disruptions continued to plague consumers following a spike in COVID-19 cases in December and January, said sector analysts.

Against this backdrop, Alibaba’s revenue climbed 2% year-over-year to RMB208.2 billion for the quarter, in line with consensus forecasts.

Revenue at Alibaba’s China commerce retail business, its biggest sales engine, dipped by 3% in the quarter to RMB132.06 billion. The segment’s quarterly customer management revenue, mainly marketing services and commissions on transactions, dropped 5% year-over-year.

Many market watchers track Alibaba’s revenues as a proxy for consumption in China, given its size. Since Shanghai went into lockdown to limit the spread of the coronavirus in February last year, consumers have been cautious, said sector analysts.

“We will be investing in increasing user growth and in building a prosperous ecosystem,” said Trudy Dai, CEO of the Taobao & Tmall Group. Dai was also speaking on the call with analysts.

Yet there are recent signs that they are starting to loosen their purse strings. China’s retail sales of consumer goods jumped 10.6% in March and 18.4% in April year-on-year, albeit from a low base.

Alibaba’s earnings report card showed that the gross merchandise value generated by sales of online physical goods over digital marketplaces Taobao and Tmall, excluding unpaid orders turned positive in March, boosted by solid growth in the fashion & accessories and healthcare categories.

"We have been seeing some pretty good results in March and April," said Dai, especially in terms of growth in users and orders.

Some retailers are also seeing a recovery in China. Earlier this month, one of the world’s largest luxury goods groups, Richemont, noted a “strong rebound” in sales in mainland China, Hong Kong and Macau during the three months ending March 31.

Other harbingers of rising business activity across Alibaba’s digital ecosystem included an uptick in delivery service Ele.me's unit economics year-over-year as the average order value rose and delivery cost per order fell.

China started relaxing COVID-related restrictions on Dec. 7 and removed quarantine requirements for international travelers on Jan. 8. Average daily active users of Amap, which provides digital map, navigation and traffic information, hit a record high of 150 million in March.

Online travel platform Fliggy’s domestic hotel booking value leaped over 70% in March compared with the same period in 2019, driven by a surge in demand for business and recreational travel.

International Commerce Growth

Looking further afield, Alibaba’s international commerce retail businesses registered a combined order volume growth of 15% year-over-year for the quarter.

Cross-border retail marketplace AliExpress and Southeast Asian e-commerce platform Lazada recorded double-digit order growth during the quarter. Lazada continued to increase its buyer base and improve its monetization rate.

Among other business groups, Alibaba’s logistics arm Cainiao posted quarterly revenue, before inter-segment elimination, up 15% year-over-year at RMB18.92 billion.

Historic Opportunity In Generative AI

Alibaba’s Cloud segment, comprising Alibaba Cloud and DingTalk, quarterly revenue before inter-segment elimination declined 3% year-over-year to RMB24.56 billion, including revenue from services provided to other Alibaba businesses.

The year-over-year drop reflected delivery delays of hybrid cloud projects given the surge in COVID-19 cases in January, the normalization of demand for content delivery networks — groups of servers —compared with the same period last year, as well as the continued impact from a top customer phasing out the use of cloud services.

Alibaba Cloud aims to expand its public cloud customer base and increase cloud utilization, and leverage the historic opportunity in generative AI.

In April, Alibaba Cloud unveiled its latest large language model (LLM), Tongyi Qianwen, which means ‘seeking truth through a thousand questions’ in Mandarin. Alibaba plans to integrate the new LLM into all business applications across its ecosystem soon, from DingTalk, Alibaba’s digital collaboration workplace platform, to Tmall Genie, a provider of IoT-enabled smart home appliances.

Recently, Alibaba Cloud cut prices of some core utility products, including computing, storage, networking and security products, by up to 50%. It believes the move will help increase public cloud adoption in China and unlock emerging opportunities to leverage AI technology for enterprises.

"Our price strategy in cloud has attracted a lot of interest and it's been very well received by the market," said Zhang.

To learn more about the group restructuring, visit Alizila's company news hub

Additional reporting by Elizabeth Utley

This article has been updated to include comments and analysis from Alibaba's earnings call with analysts on May 18