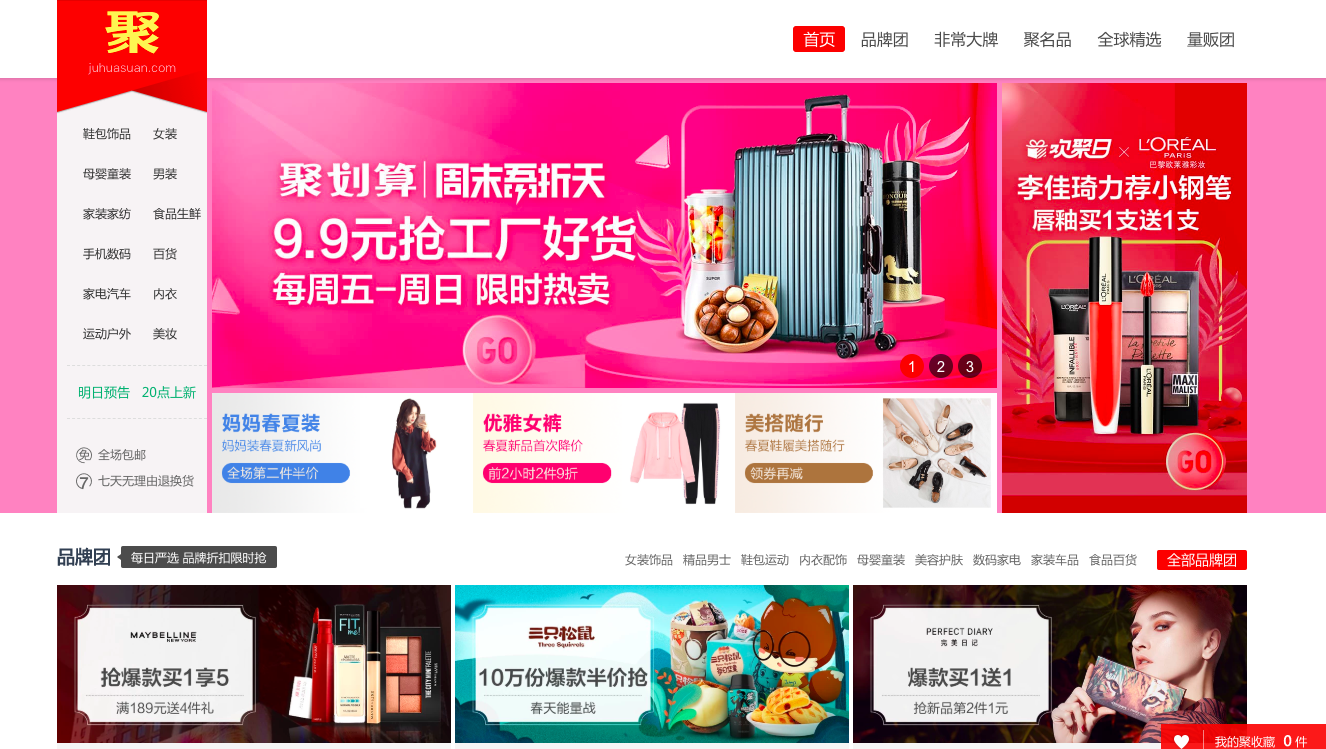

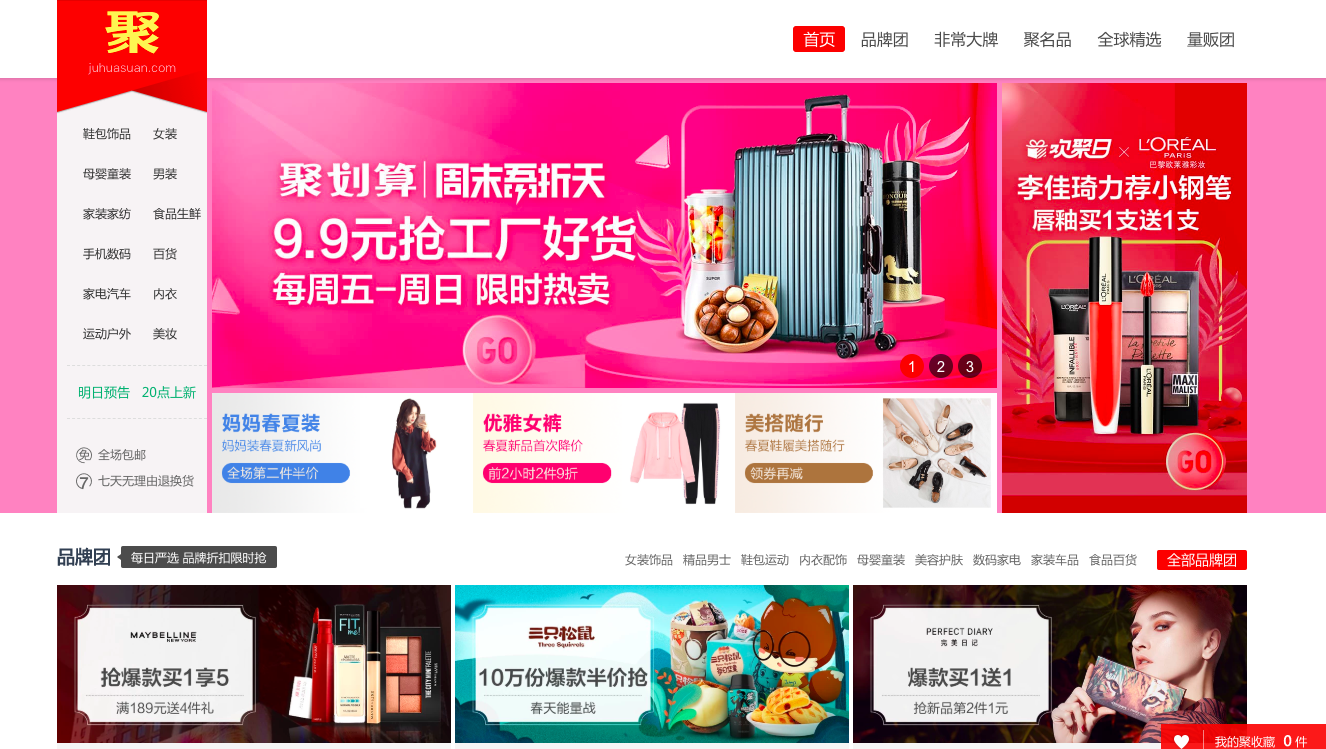

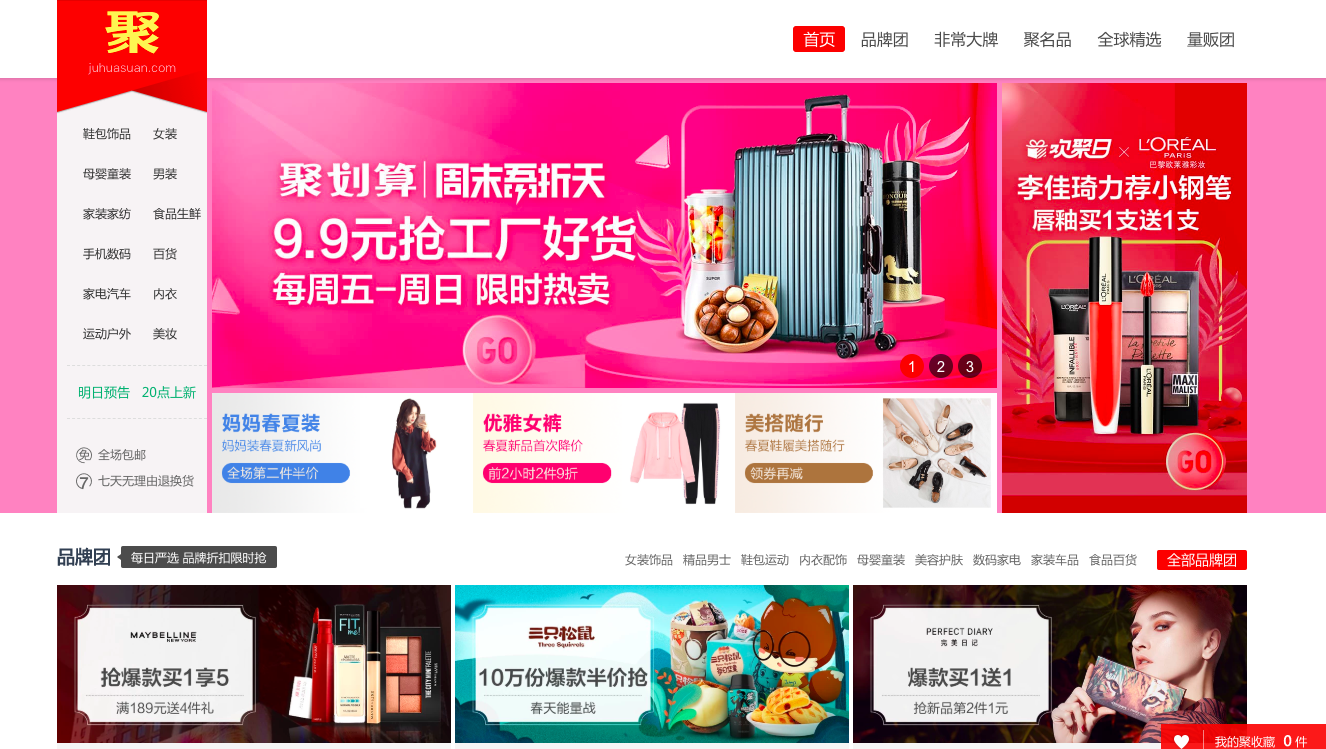

Alibaba Group is revamping Juhuasuan, the company’s group-buying and flash-sale platform, by repositioning it as the top destination for Chinese consumers, especially those in lower-tier cities, looking for quality goods at competitive prices.

As part of the upgrade, Alibaba is emphasizing campaigns with products supplied directly from factories and farms as a way to cut costs for the end consumer, according to a statement. Also, Juhuasuan will expand its efforts to help manufacturers digitize their factories through its consumer analytics and Internet of Things technology, as it looks to improve efficiencies across the product life cycle and the quality of offerings on its e-commerce platforms.

“We don’t believe [that China is experiencing] a ‘consumption downgrade,’ but we recognize that Chinese consumers have diverse demands and are [trading up] from different starting points,” said Jiang Fan, president of Taobao and Tmall. “We want to help the 1 billion consumers in China upgrade their consumption and gain more access to high-quality products.”

Jiang said his major goals for 2019 are to help consumers in tier-4 and tier-5 cities and rural areas access quality, value-for-money products and to help merchants reach even more consumers, especially those in smaller cities, in addition to helping manufacturers go digital while boosting sales for farmers.

The announcement comes as smaller cities emerge as the biggest driver of new user growth for Taobao.

Jiang said that 80% of the platform’s new users between July and September last year were from lower-tier cities or rural areas, adding that this was a prominent trend throughout 2018. As Taobao’s mobile monthly active users grew from 580 million in 2017 to 699 million in 2018, this would mean that most of the 120 million new users earned did not come from Tier 1 mega-cities, such as Beijing or Shanghai, but from the smaller cities across China.

In a 2018 report, Morgan Stanley wrote it expects consumption in China’s lower-tier cities to triple to $6.9 trillion by 2030. The investment bank also found that consumers in smaller cities are catching up with tier-1 and tier-2 markets in valuing quality over price.

While there is no official ranking from the Chinese government, media publications and analysts often categorize Chinese cities into tiers. Defined based on population, gross domestic product and other criteria, top-tier cities tend to be super metropolises such as Beijing, Shanghai and Guangzhou.

Other services catering to the price-conscious will also become a part of the upgraded Juhuasuan platform, such as “Daily Deals,” a unit dedicated to enabling factories that sells directly to consumers. Daily Deals is currently on a mission to digitize 2,000 factories in China, with plans to expand to 10,000 factories. It recently provided analytics and technical support to a Zhejiang-based sock manufacturer, helping tweak its designs in ways such as shortening the length by 5 millimeters or adjusting the tightness according to consumer preferences. As a result, the factory cut production costs by 7% for each pair and ultimately sold 1.53 million pairs in three days on the Daily Deals site.

Under the new structure, Juhuasuan aims to drive successful sales and marketing campaigns for 30,000 brands, including multinationals L’Oreal and Unilever and domestic brands Midea and Belle. In 2019, it plans to bring its “Fans Carnival” online sales event to 200 tier-3 and tier-4 cities, during which it will help brands localize marketing strategies based on the different lifestyle habits of each city. New tools, such as an online weekend clearance-sale service, are helpful to sell excess inventory, especially for brands such as Danish fashion group Bestseller. The brand sold nearly 100,000 items over a weekend, the equivalent of the combined daily sales of 2,000 of its physical stores.

Separately, 22 brands have signed on to pilot Juhuasuan’s new sub-brand development program, which helps international companies design a local brand specifically for the China market, or help a high-end brand launch a secondary, affordable line that offers “luxury for less.”

“We are gradually shifting our ‘consumption-upgrade’ strategy to a more-tiered take on consumption,” said Jessica Wang, general manager of digital and e-commerce marketing at L’Oreal China. “Our company owns 23 brands, from premium brands like Lanc√¥me to mainstream labels such as Maybelline, L’Oreal Paris — a wide spectrum. To meet different tiered demands, we will tap Taobao’s big data for a large number of C2B [consumer-to-business] projects, with some already underway.”

Another goal is to incubate more than 1,000 industry clusters worldwide, up from its current 300 partners, including floriculture suppliers in Yunnan Province, bamboo-paper makers in Zhejiang and cosmeceutical makers in South Korea. Juhuasuan bridges upstream farmers and manufacturers with e-commerce merchants, while designing promotional campaigns to help them sell to consumers. Through a sales event ahead of Valentine’s Day, Juhuasuan sold more than 500,000 roses from Yunnan flower fields to homes across China in three days — selling at nearly half the market price, even as competitive as RMB 9.9 ($1.47) per bundle. Among all the orders sold, almost half came from lower-tier cities.