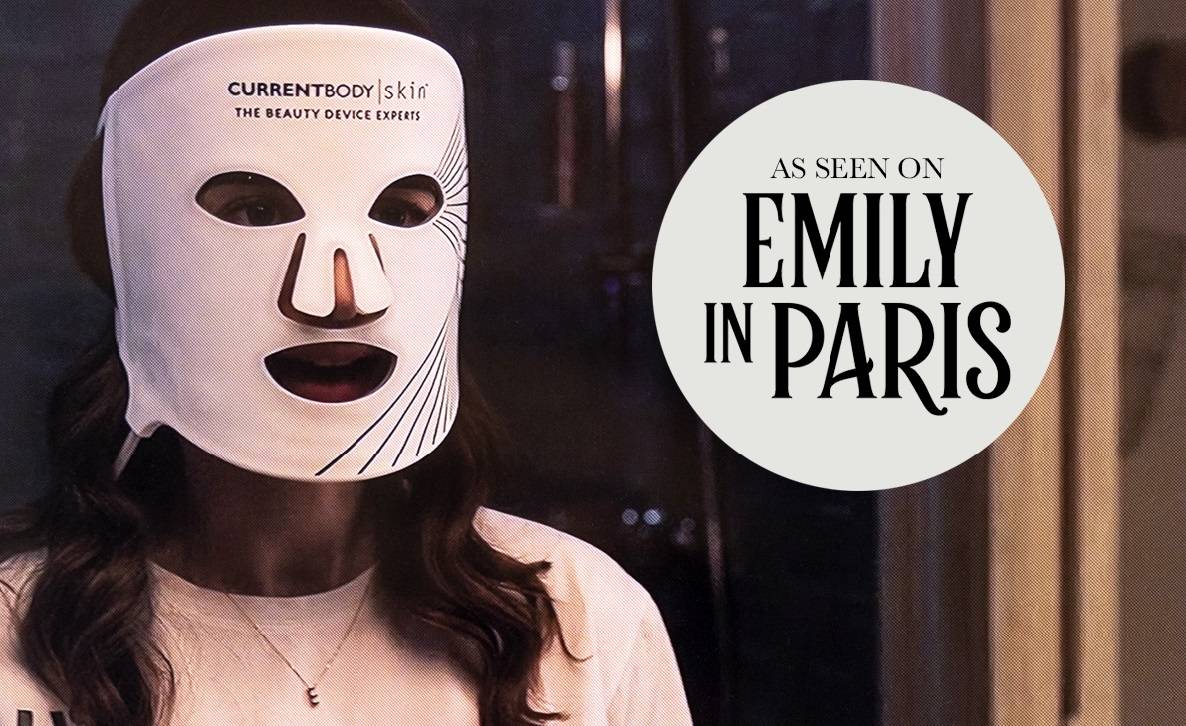

Britain’s CurrentBody, the brand behind the cult LED mask seen on hit Netflix series, “Emily in Paris”, is taking its China business to the next level.

Founded in 2009, the beauty-tech company entered China via cross-border marketplace Tmall Global a decade later. Now, China is one of its biggest markets and a window into emerging shopping trends.

It’s been a steep learning curve as the firm has studied Chinese shopping habits, built a product-development team for the market and embraced new marketing tactics such as livestreaming.

“It’s probably taken me all that time to start to really understand the China market,” said Laurence Newman, the company’s 49-year-old CEO and co-founder, in an interview with Alizila.

Newman believes it’s worth the effort. China’s at-home beauty devices market is growing fast. During the pandemic, Chinese consumers experimented with new ways to care for their skin and beauty needs without leaving home. Consultancy Daxue forecast in March that the market would exceed RMB20 billion ($2.91 billion) by 2026, up from RMB6.6 billion in 2019.

Back in its Cheshire headquarters, CurrentBody is also watching sales climb. After taking full ownership of its China joint venture, turnover is on track to hit GBP86 million ($106.1 million) this fiscal year, said Newman while noting that results could fluctuate depending on performance during China’s 11.11 shopping festival this month.

Chinese consumers’ appetite for technology and customized recommendations, along with the rapid development of the lazy economy and the rise of Generation Z, is prompting beauty brands to invest in at-home beauty devices. Other overseas brands are also gaining traction in China, such as British-Singaporean brand Dyson and Israel’s TriPollar.

“The co-existence of beauty and tech is integral for Chinese consumers and I anticipate it will expand globally for the future commerce experience,” Zarina Kanji, an executive at Tmall Global based in London. Kanji noted that 85% of consumers on Tmall Global are under 39 years old and 60% are under 30.

Trend Spotting

Beauty trends that start in China can quickly go global, given the size and dynamism of the market. Nimble companies on the ground have a head start.

One of the trends Newman first spotted in China was women and men investing in anti-aging products from a younger age. For beauty companies like CurrentBody that means a far bigger addressable market.

“There’s definitely been a shift towards a younger demographic of anti-aging; and there’s absolutely no doubt that it started in China,” said Newman, who has been plugging away at beauty technology for years, having sold professional units into clinics and owned cosmetic clinics.

CurrentBody set up a product team in China to react faster to emerging trends. It has recently launched a 4-in-1 LED mask after the team’s research found Chinese consumers wanted more brightening products.

“Things move even quicker in China than anywhere else. So, if your technology or product is slightly out of date, it’s going to be a bit exposed there,” said the Mancunian executive, explaining why he chose to launch the mask first in China.

Regulation is also evolving rapidly in China as the country looks to make products safer. “The entry threshold for the beauty device industry has significantly increased,” said Daxue in a report.

11.11 Livestreaming

While China’s e-commerce market may be effervescent most of the year, during the 11.11 shopping festival between mid-October and mid-November, it’s on steroids.

Brands routinely use 11.11, also known as Singles’ Day, to launch products and build brand awareness, often by heavily discounting stock. They’re betting on a huge surge in volume during what has become the world’s largest online retail event, routinely topping Black Friday and Cyber Monday combined.

Following a slowdown in consumer spending during the coronavirus pandemic, merchants and platforms are seeking to kickstart demand by delivering value for money to Chinese consumers, said consultants. This is CurrentBody’s fifth 11.11 and Newman has noticed more conservatism by Chinese shoppers than before.

“There's a little bit of hesitancy over buying. Before, there was more impulse buying.”

While big discounts are not part of the luxury beauty brand’s strategy, it wanted to offer something meaningful for consumers during the shopping festival. So, it decided to give away a radio frequency device with its 4-in-1 mask to Tmall Global customers.

“Our offer looks and feels like added value rather than a huge discount in price. So, massive added-value for the customer in a slightly different way that also introduces them to another CurrentBody product,” said Newman.

Creating Buzz

Once it had the product designed for the Chinese market in place and its 11.11 offer set, it engaged a group of influencers to generate buzz.

Gauging the level of marketing investment is tricky, said Newman. Brands might see a one-off spike from engaging a big-name KOL, but sales would likely sink back afterward unless they already have a solid sales base in China.

“The temptation is always to hit the highest-level KOL, which isn't always possible,” said Newman, who has gradually built up a small army of KOLs, from the grass-roots influencer to top-billed Beijing-based key opinion leader (KOL), Zhang Mofan, or Momo as she’s widely known. Momo traveled to CurrentBody’s British headquarters in October to demo the 4-in-1 mask for her 20 million followers.

Momo took her own product team with her to the UK and toured the CurrentBody factory to understand how it develops LEDs.

“There was a time when they would sell anything. Now, they have an established business, they want to grow their followings, be educational, be less price driven all the time, and they want to create some actual genuine content,” said Newman.

Momo ran warmup livestreams ahead of 11.11, while CurrentBody’s support team in China ran livestreams in tandem. CurrentBody is also conducting livestreams in-house to Chinese consumers.

“We have hosts doing 12-hour livestreams introducing the products on Tmall. I've gone live myself on 11.11, but that always makes the sales go the wrong way,” said Newman, laughing.

Next Steps?

CurrentBody’s strategy is also evolving as the market grows.

The firm is gradually shifting from selling only third-party brands to selling its own products in China. It is also adopting a more omnichannel approach, starting with pop-ups in prominent stores such as the Printemps emporium in Paris and John Bell & Croydon, the pharmacy to Her Late Queen Elizabeth II, off London’s Harley Street.

As the brand grows in China, Newman sees a physical footprint as the next logical step.

“A physical presence in China over the next few years as the brand grows is very likely.”