Assessing damage caused to their rides has just gotten a lot easier for car owners in China, with the rollout of a video-based, artificial-intelligence app from Ant Financial.

The Alibaba affiliate last week launched version 2.0 of its Dingsunbao (Loss Assessment Master) app, giving drivers the same power in their hands to provide detailed car-damage information to insurers and claim vehicle insurance in real time as Ant Financial gave professional insurance adjusters just under a year ago.

The first version of Dingsunbao has already helped insurers, including China Taiping, China Continent Insurance, Sunshine Insurance Group and AXA Tianping process claims tens of millions of times at a rate of speed much faster than human adjusters alone could handle.

“Dingsunbao has already helped the insurance industry to save over RMB 1 billion on claims handling, while saving claims adjusters around 750,000 hours of effort,” said Yin Ming, president of Ant Financial’s Insurance Business Unit.

The AI also ensures a high degree of accuracy in damage assessment, Ant Financial said when it launched Dingsunbao last June. Dingsunbao was aimed at standardizing damage assessment and making it more objective, reducing the potential for human adjusters on the scene to be influenced by drivers involved in an accident.

Secret Sauce is 46 Patents

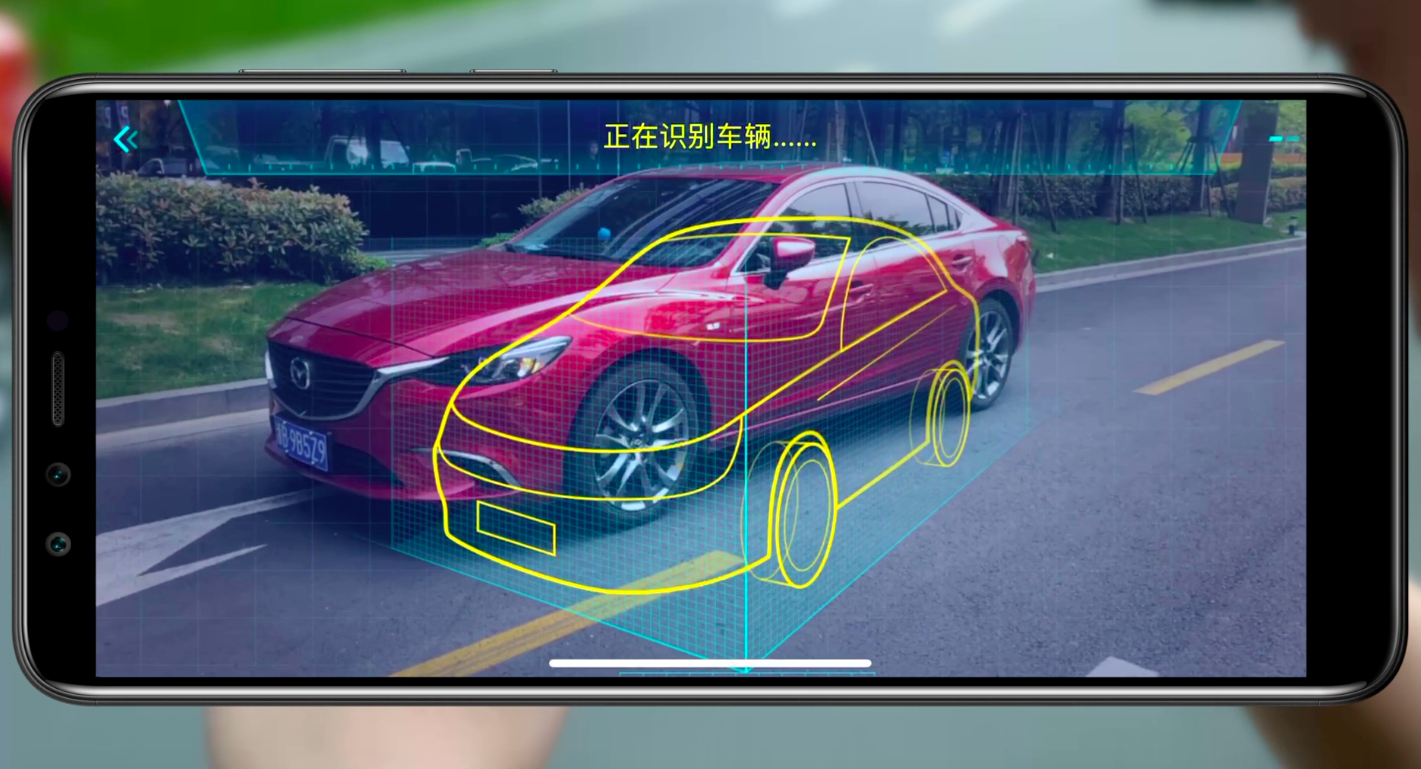

With Dingsunbao 2.0, car owners can use their smartphones to capture video clips of their cars, following onscreen guidelines. Vehicle damage information will be displayed automatically, including where and how to repair the vehicle and how much the car owner can claim from insurers, saving time in filing claims and offering transparency in what’s likely to be covered.

Dingsunbao 2.0’s secret sauce includes 46 patented technologies, such as simultaneous localization and mapping, a mobile deep-learning model, damage detection with video streaming, a results display with augmented reality and others.

The technology doesn’t obviate the need for a human touch, with professional adjusters still required to sign off on all cases.

Resolving a Pain Point

But Ant Financial said there’s little doubt that Dingsunbao 2.0’s technological advancements “help to resolve the pain points of the vehicle insurance industry.” It said public data showed nearly 46% of car owners reported a bad experience in making vehicle insurance claims. And nearly 75% of vehicle insurance companies in China are losing money, Ant Financial said.

That would, at least partially, account for the growing interest among insurers in using technology-based innovations to streamline and improve operations. More insurers are now exploring how to use AI for loss assessment and insurance claims, Ant Financial said.

Last August, CIITC launched a cloud platform for vehicle loss assessment, and Pingan OneConnect launched its Intelligent Claim Payment system last September.

Dingsunbao’s intent is to be an open platform that helps all insurers improvement efficiency, and now, also serve car owners better.