Photo credit: Alibaba Group

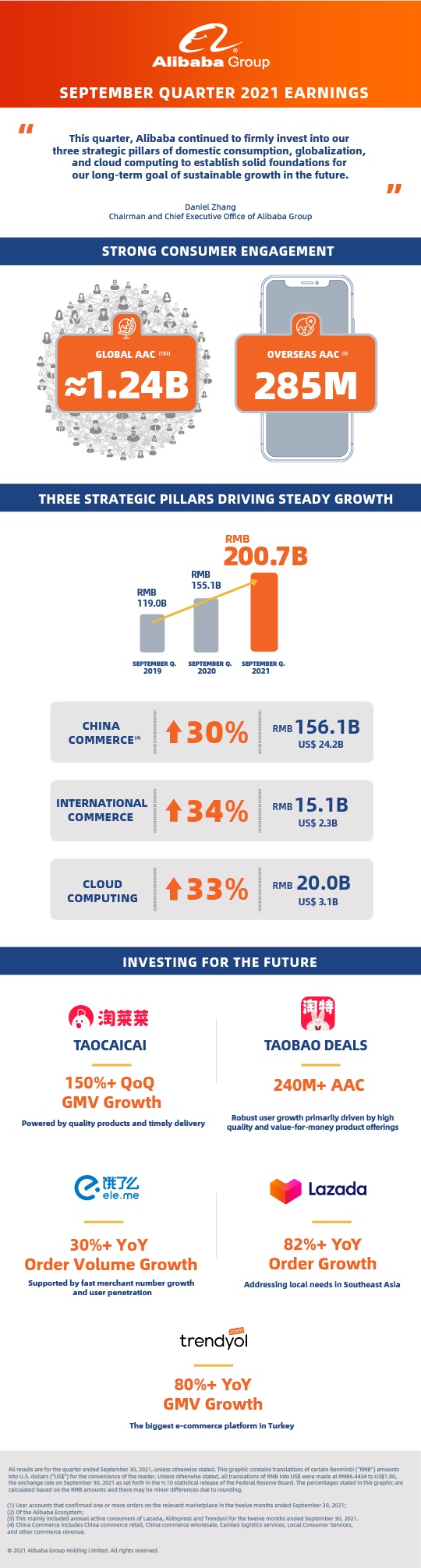

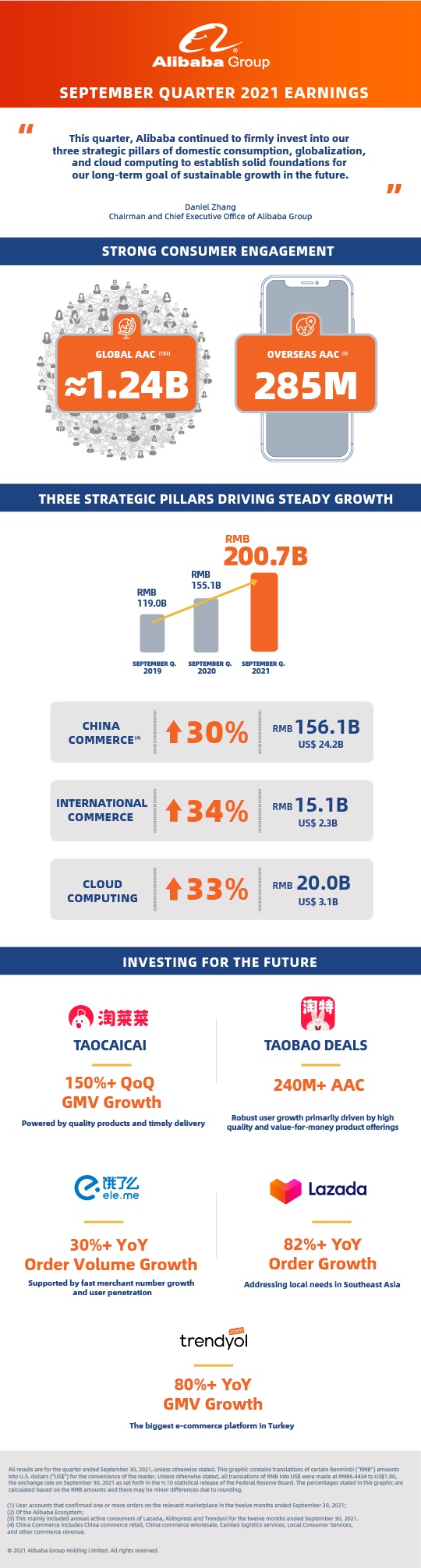

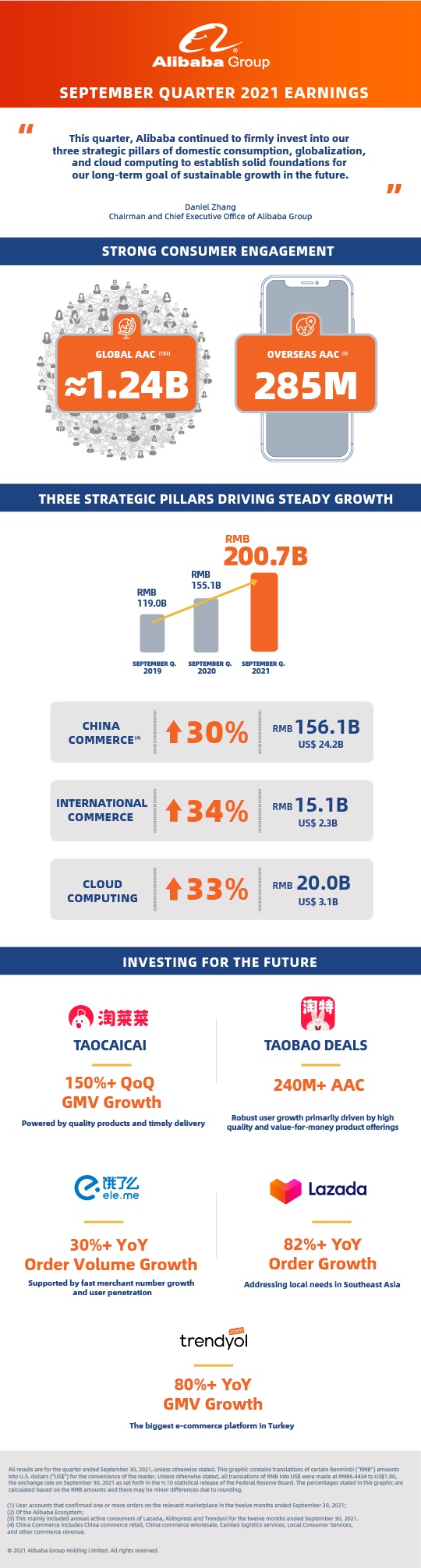

Alibaba Group’s second-quarter revenue climbed 29% year-over-year to RMB200.7 billion (US$31.1 billion), driven higher mainly by its China commerce retail business and cloud computing.

Alibaba’s annual active consumers (AACs) expanded to about 1.24 billion for the twelve months ended September 30, adding roughly 62 million from the twelve months ended June 30.

“We are on track to achieve our longer-term target of serving two billion consumers globally,” said Daniel Zhang, Chairman and Chief Executive Officer of Alibaba Group, in a statement on Thursday.

Alibaba continues to invest in domestic consumption, globalization, cloud computing as flagged in May, to build a solid foundation for sustainable growth, Zhang added.

Alibaba’s adjusted EBITA, which reflects underlying performance, dropped 32% year-over-year to RMB28 billion for its quarter ended September 30.

Seed investment in businesses, such as bargain app Taobao Deals, Local Consumer Services, Community Marketplaces and Singapore-headquartered e-commerce platform Lazada, rose by RMB12.6 billion year-over-year. Excluding these investments, profits from commerce would have been stable year-over-year.

“During this quarter, our continued investments in key strategic areas have resulted in robust growth for these young businesses,” said Maggie Wu, Chief Financial Officer of Alibaba Group.

The Hangzhou-headquartered company revised its fiscal year 2022 revenue forecast to grow 20% to 23% year-over-year. Showing confidence in its long-term growth plans and China’s economic potential, Alibaba continued to repurchase American depositary shares (ADSs), snapping up about 26.9 million ADSs in the quarter, which returned about US$5.1 billion to shareholders, under its previously announced share repurchase program.

Nurturing Winners

Alibaba continued to invest in markets outside China, resulting in consumption picking up pace on e-commerce platforms within its ecosystem, including Lazada in Southeast Asia, Trendyol in Turkey and Daraz in South Asia.

The group served 285 million consumers outside China after attracting 20 million more consumers to its platforms in the twelve months ended September 30.

Both retail and wholesale international commerce businesses gathered momentum, with an aggregate year-over-year increase in revenues of 34% to RMB15.1 billion.

Orders at Lazada in the quarter jumped over 82% year-over-year. Trendyol notched up gross merchandise value (GMV) growth in the quarter of over 80% year-over-year based on a constant currency.

During the coronavirus pandemic, supply chains globally have suffered bottlenecks and backlogs. Cainiao Network, Alibaba’s logistics arm, helped smooth parcel delivery by strengthening its end-to-end logistics. Cainiao operated over 3 million square meters of warehouses dedicated to cross-border businesses as of September 30.

Cainiao Network’s logistics services revenue hit RMB9.9 billion in the quarter, a 20% jump from RMB8.2 billion in the same quarter last year, primarily due to the increase in the volume of orders fulfilled from cross-border and international commerce retail businesses.

Cloud Migration

Cloud computing revenue grew 33% year-over-year to a quarterly record of RMB20 billion, mainly thanks to growth in the internet, financial services and retail industries.

Global cloud industry revenue will likely climb to US$474 billion in 2022 from $408 billion in 2021, according to technology research and consulting company Gartner. Gartner ranked Alibaba third in the worldwide infrastructure as a service cloud market (IaaS).

The ongoing pandemic and the ubiquity of digital services are making cloud the centerpiece of new digital experiences. “There is no business strategy without a cloud strategy,’ said Gartner’s Milind Govekar in a recent report.

We are on track to achieve our longer-term target of serving two billion consumers globally

Alibaba continued to support R&D to maintain a cutting edge in technology, resulting in breakthroughs, new product releases and upgrades in the quarter. During its technology conference, Apsara, in October, Alibaba unveiled an in-house processor designed for use at its data centers, dubbed Yitian 710. It also announced the fourth-generation X-Dragon architecture with a latency as low as 5 microseconds, further accelerating data-intensive applications on the cloud.

Lower-Tier Cities

Alibaba pushed deeper into remoter parts of mainland China during the quarter, boosting growth in businesses from value-for-money app Taobao Deals to Community Marketplaces.

The ranks of users of Taobao Deals continued to swell, including a larger contingent of new consumers from lower-tier cities. The app helps merchants sell directly to consumers, cutting costs in the process. There were over 240 million AACs on Taobao Deals in the twelve months ended September 30.

Alibaba’s Community Marketplaces, known as Taocaicai in China, continued to expand in lower-tier cities, with GMV leaping over 150% quarter over quarter.

Reaching beyond China’s major cities wouldn’t be possible without reliable logistics. Cainiao Post covered more than 1,000 counties and towns in less-developed areas of China as of September 30. The number of daily packages handled in these markets grew over 280% year-over-year.

Hive of Commerce

China’s retail sales for the quarter grew 5% year on year as consumption normalized from the coronavirus pandemic shock and the subsequent rebound in spending.

Alibaba’s core engines, China retail marketplaces and New Retail businesses, counted about 863 million AACs for the twelve months that ended September 30.

Revenue from China commerce retail business in the quarter was RMB126.8 billion, up by a third compared with RMB95.5 billion in the same quarter of 2020. Customer management revenue grew 3% year-over-year, primarily due to single-digit physical goods GMV growth that resulted from slowing market conditions and more players in China’s e-commerce market.

High-frequency online shopping services gained popularity among Chinese consumers. During the quarter, online catering and delivery service Ele.me recorded 28% AAC growth year-over-year. Order volumes climbed over 30% year-over-year with an increasing percentage coming from non-restaurant orders and strength in the grocery and healthcare categories.

Alibaba’s commercial engine was firing on all cylinders during the 11.11 Global Shopping Festival, an 11-day consumption bonanza that generated RMB540.3 billion in GMV, excluding unpaid orders, with a record 290,000 brands participating.

Going forward, other yardsticks for success will come to the fore during the shopping festival, such as customer loyalty and sustainability. Alibaba Cloud noted that during this year’s 11.11 it reduced carbon dioxide emissions by 26,000 tons through the use of renewable energy at a major data center.

For more detailed information on the earnings announcement click here