As Chinese consumers increasingly vacation overseas, their beloved mobile-payment apps are following them, says a report released jointly by U.S. research firm Nielsen and Alipay. That’s making it easier for travelers to make purchases and conduct other business while abroad.

But the ability of mobile-payments apps to ride the China outbound tourism trend doesn’t benefit only consumers, according to the report, which was released Monday. More than half of the businesses surveyed saw an increase in both the foot traffic in their stores and the size of transactions made by Chinese travelers after they adopted Alipay, the mobile-payments app owned by Alibaba Group affiliate company Ant Financial.

“On the one hand, China’s mobile payments providers are extending their service offerings for Chinese consumers. On the other hand, they are developing their businesses into overseas markets, where merchants, big or small, can benefit from adopting their services,” Nielsen wrote.

Watch: Chinese tourists use Alipay overseas in Las Vegas

For the 2018 Trends for Mobile Payment in Chinese Outbound Tourismreport, Nielsen surveyed about 2,800 Chinese tourists who had traveled outside the country in the past year and plan to do so again in the coming 12 months. In addition, the company interviewed 1,244 merchants at tourist attractions in Singapore, Malaysia and Thailand – popular destinations for Chinese vacationers – to see how the adoption of mobile payments has benefited them. This was the first year that the annual survey included merchants’ adoption of mobile payments in addition to their use by Chinese consumers.

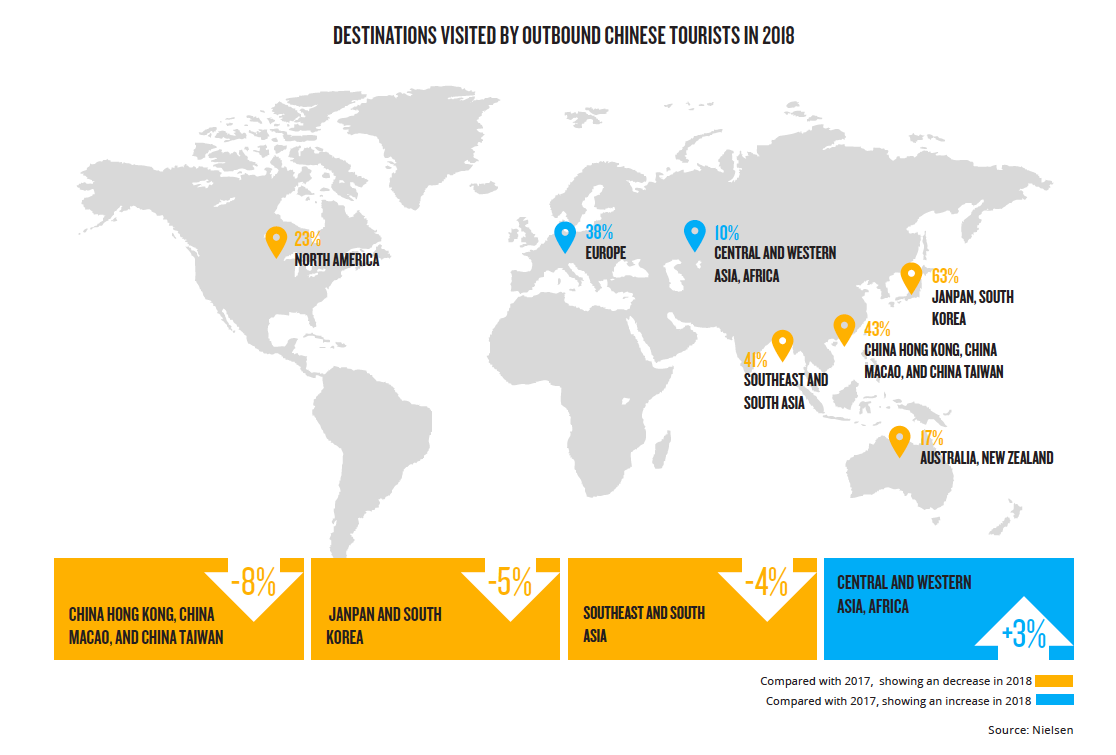

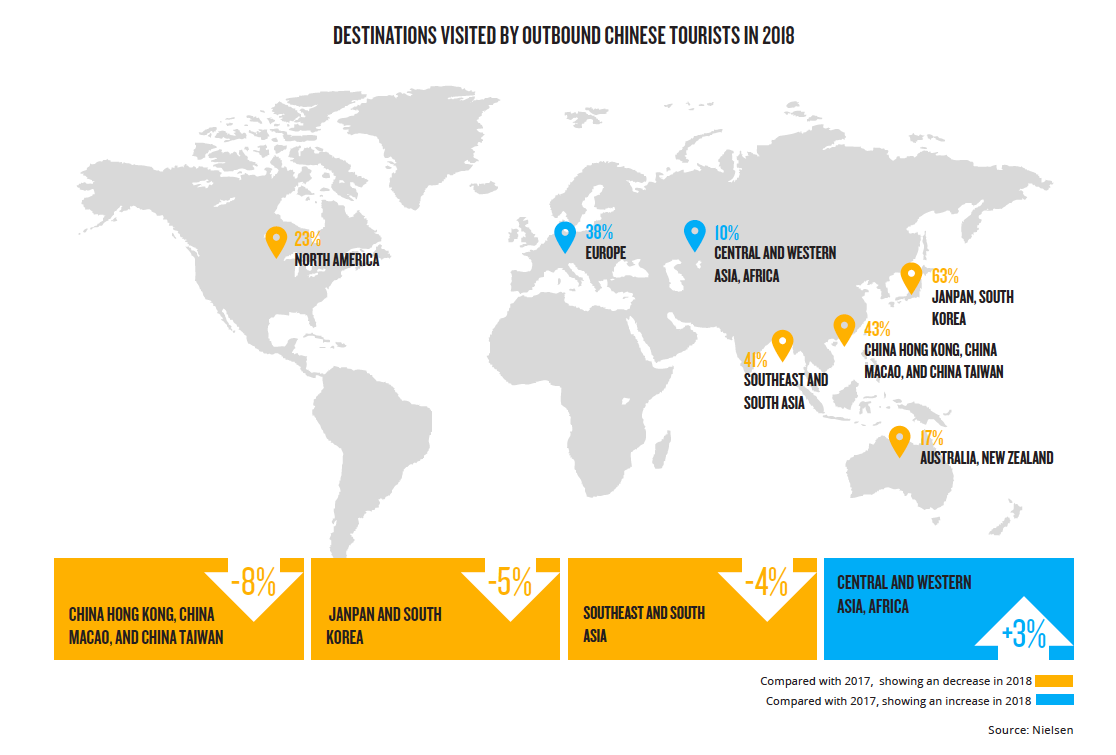

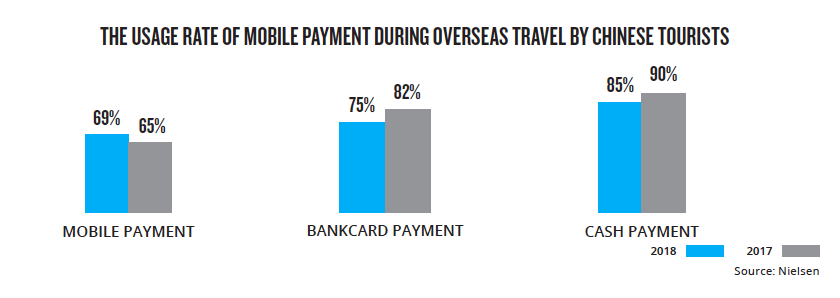

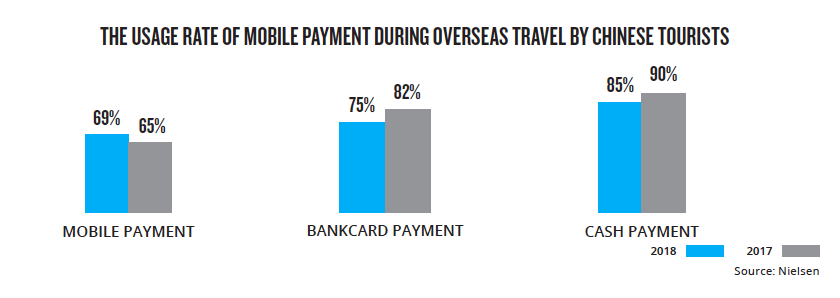

Nielsen found that Millennials and consumers in second-tier cities – think Hangzhou and Chongqing rather than Beijing or Shanghai – drove much of the growth behind the 140 million outbound trips by Chinese tourists last year, an increase of 13.5% year-over-year. They’re traveling to a range of places, from Japan and South Korea in Asia to Europe and the U.S. They’re also spending more – on shopping, accommodation and food– and increasingly using apps such as Alipay to pay for them compared to 2017.

And the usage was not age-specific, according to the report. While the adoption of new technologies may seem likely to be more likely amount China’s young consumers, the research showed that 68% of Chinese outbound tourists born between 1970 and 1979 used mobile payments in 2018.

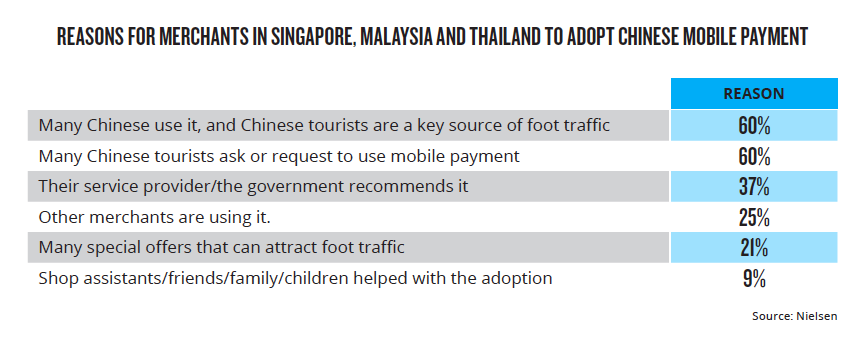

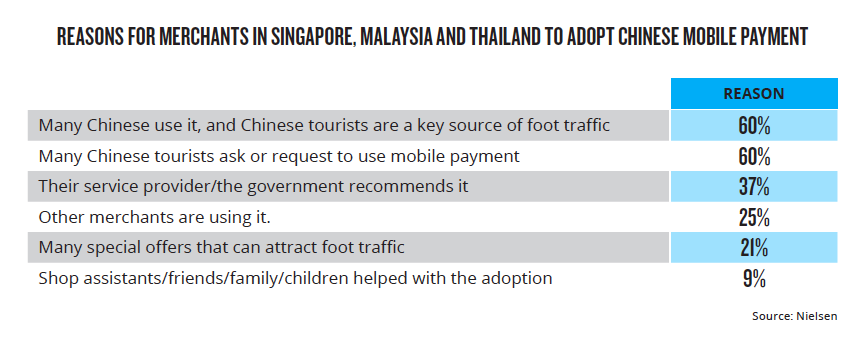

This is good news for overseas businesses, as mobile-payments providers such as Alipay move into new markets abroad in order to better serve the customers they have at home, Nielsen wrote. In fact, 58% of surveyed merchants in Singapore, Malaysia and Thailand said that their foot traffic increased after adopting Alipay, while 56% claimed an increase in sales.For Chinese mobile-payments apps in general, there was 40% growth in foot traffic and sales.

The adoption of mobile payments by these merchants has closely tracked the growth of Chinese outbound travel. According to the report, only 12% of them offered Alipay in 2016, while the remaining 88% added Alipay in just the past two years. The merchants surveyed said that, just like Chinese travelers, they find apps like Alipay easy to use and an increasingly important way to draw Chinese tourists to their businesses.

Alipay said that it works to make that adoption easy for merchants. The app offers them professional support for business operations, such as training sessions on the transaction process, collaboration on Alipay-based marketing campaigns and back-end operational support. In turn, the positive experiences of overseas merchants using Alipay is making it more likely that other businesses will do the same. According to Nielsen, 71% of Alipay-adopting merchants said they are likely to recommend Alipay to their peers versus 60% for Chinese mobile-payments providers in general.

Going forward, Nielsen emphasized that that Chinese mobile payment providers must keep pace with the changing demand for payments from outbound Chinese tourists. At the same time, they should focus on merchants in different parts of the world and examine what they expect out of a payment solution to ensure seamless transactions that benefit those tourists as well as the merchants.

“By utilizing these insights, as well as their existing strengths, Chinese mobile payment brands will be more able to identify where to move forward and accelerate their efforts to go global to serve more merchants and users,” the companies said.